Greetings from the Pacific Northwest, where I will be with mia familia until late Monday.

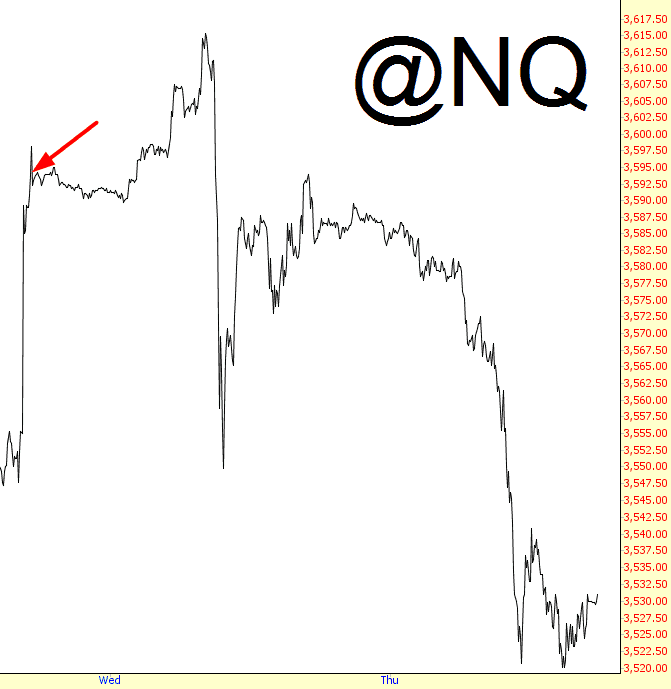

This morning, I wanted to share some thoughts about fear and the damage it can do to one’s profitability. Now fear is quite a distinct thing from frustration (both of which have been served up in ample heaps to bull and bear alike thus far in 2014). A good example of frustration is when a Sloper will write me, expressing disgust at the market and resolving to quit trading either for a while (measured in months) or permanently. I got one such email this week. I’ve marked the point at which the email arrived:

Now, this chap didn’t nail the top: indeed, it seemed he was quite correct that the insane levitation would continue, but it wasn’t that much longer after I got this email that the market began to unravel once more. As I sit typing this, the Dow, the Russell, and the S&P 500 are all in the red for the year.

But fear is a different thing altogether, and it’s something with which I’ve struggled as a trader ever since I placed my first order. In fact, my Trading Rules page, you will note I’ve laid out five rules. Four of them are actually constructed to try to combat fear in some way. I have only been partially successful at adhering to these rules, and I’m well aware of my shortcomings. On the page itself, I state, “If one day I can follow these rules absolutely consistently, I’ll be a much better trader for it.“. Well, “one day” hasn’t arrived yet.

I’m reflecting on this because of my recent trading activity. I am constantly monitoring myself to see where I’ve gone wrong and what I could have done better. I break the notion of “fear” into two categories for myself: exposure and caprice.

By “exposure” I mean how much of my portfolio is committed to the market. For 2014, I’ve been pretty aggressively exposed, dialing it up and down from about 80% to as high as 115%. I am presently at 108%. I think I’ve managed my exposure pretty well. A few years ago, it was much smaller – often at about 30% – which is probably why this permabear is still around in Spring 2014 with a positive account balance.

Caprice, on the other hand, is a constant enemy. It’s just a fancy word for “changing one’s mind on the spot”. If you took all the positions I closed in April (not that were stopped out………but that I took the initiative to close), I’m sure I regret 9 out of 10 of them. In the heat of the trading day (or, more typically, right at the start of the trading day), it might feel like a “relief’ to bail out of a position which either has a loss or has what appears to be a “sufficient” profit, but it is almost always a mistake.

I’m not sure how many trades I’ll have to regret for me to get it through my thick skull that stops and ONLY stops are the basis for exiting a trade, but hopefully I will ultimately shake this habit. The principal reason I keep such a ridiculous number of positions is so that, in the course of shooting off my toe, I still have about 100 other toes that are safe. If I were a one-position trader, it would be ruinous.