Most of you read my review of David Stockman’s Great Deformation last weekend. Our own beloved BDI goaded me into reading it (and I’m grateful he did), but BDI kicked it up a notch by reaching out to David Stockman to share the review with him. Lo and behold, I now find my review on his home page. I guess it’s a little odd to be star-struck by the Director of the OMB in Reagan’s White House, but I’m a child of the 80s, after all. Thank you, BDI!

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Way Is Not Shut

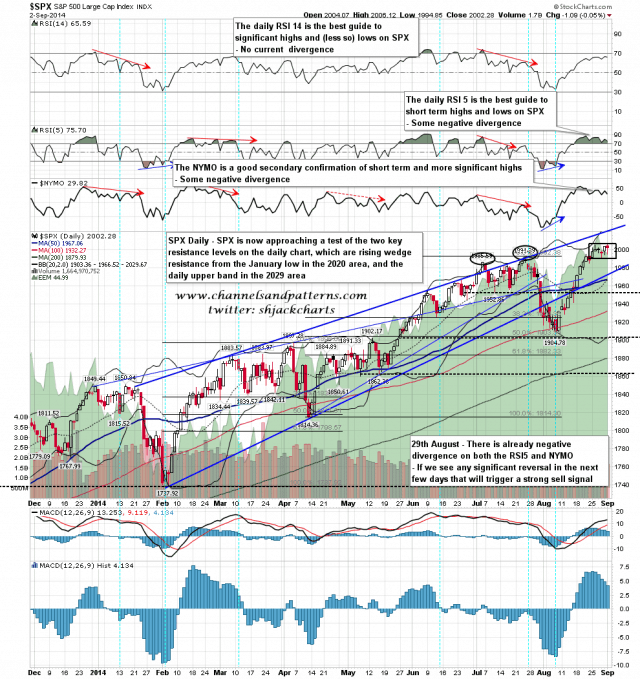

Another day of dramatic seeming action with only a small final move on the daily close yesterday, marking a fifth day of consolidation since SPX made the 2005 high. The channel support trendline on WLSH and the megaphone support trendline on Dow broke at the lows yesterday, so all the support trendlines from the August lows have now been broken. That could mark a high being made right here, but the prospects for a move to primary resistance in the 2020-30 look pretty good unless bears can put a whole day together and break the current sequence of higher highs and lows on SPX. SPX daily chart:

Rage Cleaner

With the S&P 500 down 0.05% today, it might as well have been the 4th day of the Labor Day weekend. Thus, I have zilch to say that I didn’t already say about the market over the holiday. Since I’m surrounded by Russian fencing coaches (or at least Russian-speaking Ukrainian ones) five days out of every week, I feel very at home sharing this amusing little comment cleaner:

Market Ratio Messages

Using monthly charts I want to update more big picture views of where we stand in the financial markets. This is just a brief summary [edit; okay it’s not so brief. In fact it had to be ended abruptly or else it would have just kept on rambling] and not meant as in depth analysis with finite conclusions.

I was listening to Martin Armstrong talk about his ‘economic confidence’ model and realized that the way he views gold is similar to the way I do (and very dis-similar to the way inflationists and ‘death of the dollar’ promoters do). I don’t love the way he writes, and I usually avoid these weird interview sites, but checked it out (linked at 321Gold) anyway and found him enjoyable to listen to.

Anyway, this prompted another big picture look at gold vs. the S&P 500 and as with the shorter-term views, the picture is not pretty. (more…)