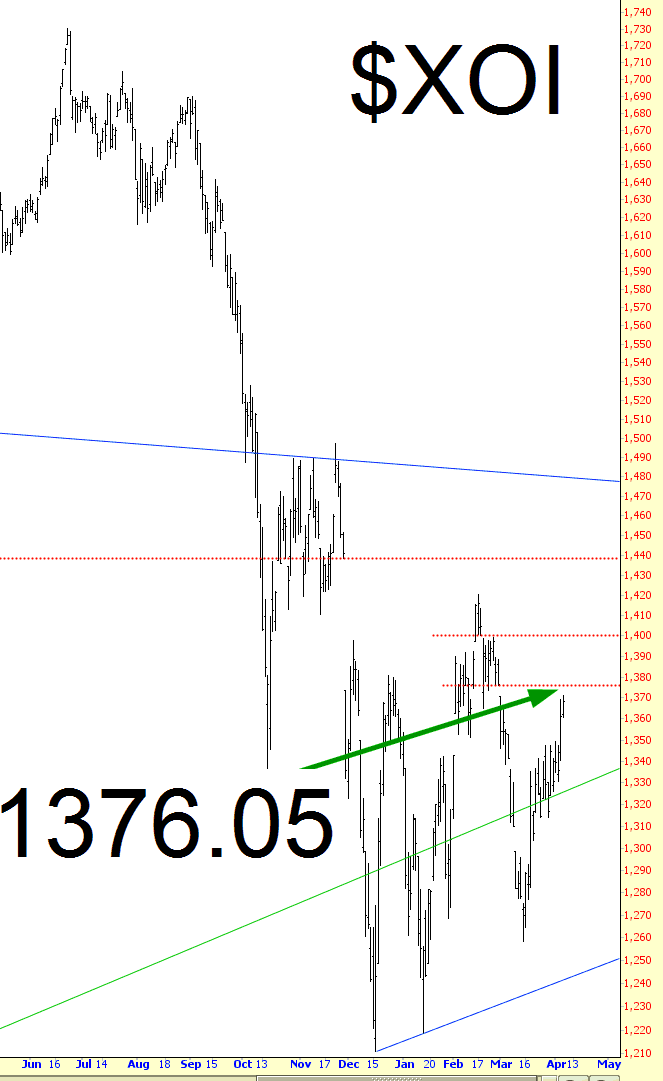

Until March 13, energy stocks were a total kick on the short side. Since then, they’ve been clawing their way back, right alongside crude oil. I have no interest in shorting crude, but as we approach the key gap I’ve pointed out below, I’m more and more interested in getting back into the short side of energy stocks.

I’ve already in a few energy positions right now; namely: BP, CLR, CSIQ, DOV, FSLR, GPOR, HFC, IOC, NBL, OKE, SM, and WPZ.

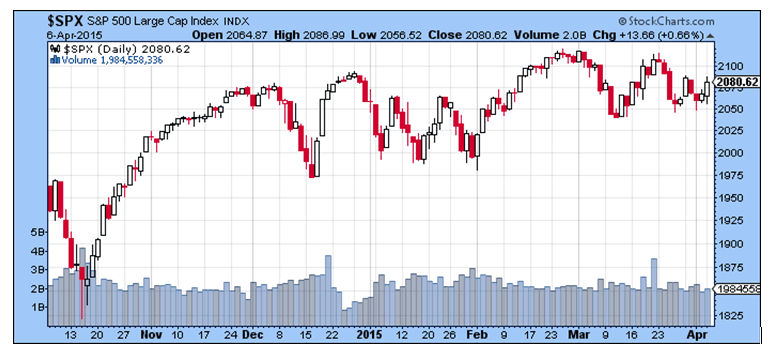

As for my portfolio in general, I amped things up Tuesday. I went from 52 short positions to 75. Let’s see what effect, if any, the Fed Minutes have on Wednesday. The meat of any move may not take place until we get a critical mass of earnings reports over the next few weeks.