Would you like to watch a biography? Or perhaps something motivational? Or humor instead? How about all those at the same time – – this is a fantastic interview with Slope’s patron saint:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Top Signal Arrived in Inbox

Oh What a Plus

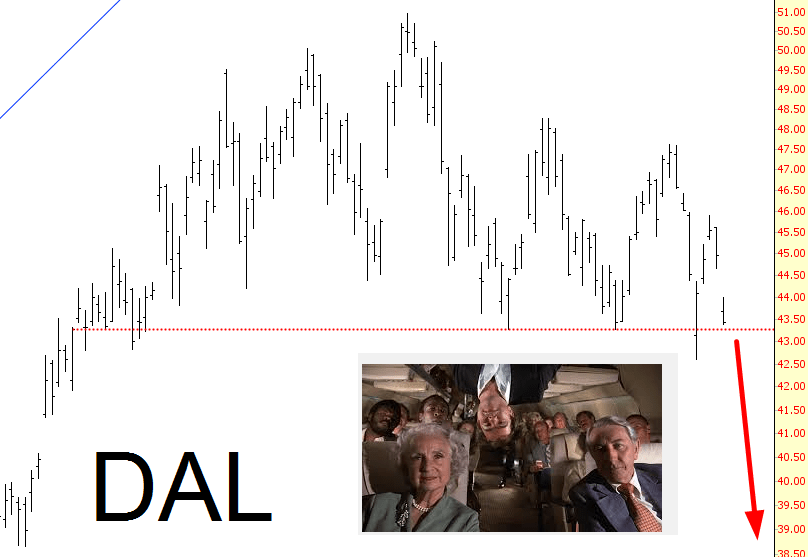

I usually keep Slope+ posts and ideas behind the beautifully manicured topiary surrounding the Slope+ garden, but I wanted to share a recent success story to illustrate (1) the kinds of cool ideas you non-plusers are missing (2) how I actually do, gasp, offer up long ideas (although, cough cough, this particular one was to go long a bearish fund).

Slope+ garden, but I wanted to share a recent success story to illustrate (1) the kinds of cool ideas you non-plusers are missing (2) how I actually do, gasp, offer up long ideas (although, cough cough, this particular one was to go long a bearish fund).

On the morning of March 25, I published a post called Aggressive Long which suggested buying the symbol DUST to take advantage of what I felt would be weakness in precious metals miners. I’ve marked the approximate publication time below with a green arrow, and I’ve tinted beneath that the suggested stop loss of 14.76 (which was never hit).