I was mentioning yesterday that the stats for today historically are strongly bullish. Dow has been up 16 of the last 21 first trading days of April. Does this mean that the market can’t close down? No, but it does mean that the bears are playing a game today with the odds heavily stacked against them, and the obvious lean is for a green close unless we see very strong evidence to the contrary. In effect the first trading day of April is a little slice of the year that is forever 2013, and that was a very bad year to lean short.

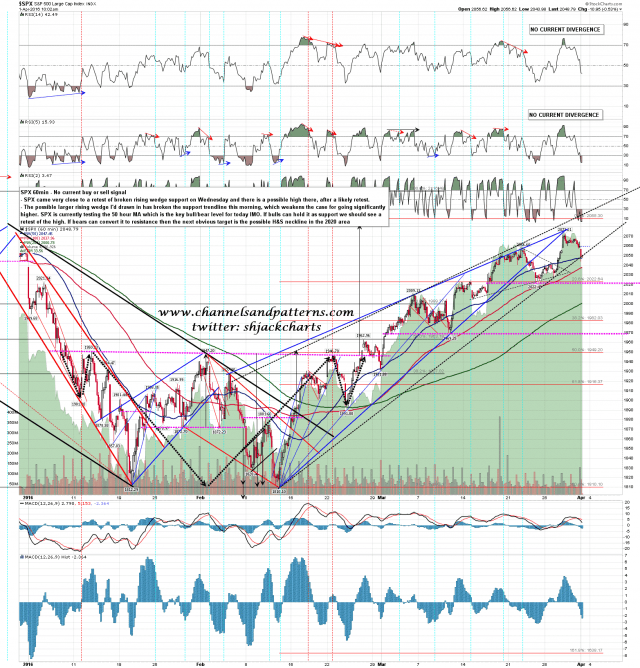

I mentioned the obvious retest and support level at the SPX 50 hour MA yesterday morning and that was tested this morning, and so far is holding. As long as that remains the case then I’m looking for a retest of the current rally high at 2072, though I’d note that the break below trendline support on the possible larger rising wedge that I pencilled in yesterday morning means that the odds of going much higher than that retest have dropped considerably. SPX 60min chart:

I’m using the ES, NQ and TF bonus charts that I posted for theartofchart.net subscribers at the lows this morning, and I was looking at a likely retest of the rally high on ES there, mainly on the historical stats for today. That looked a bold call then but with ES since having filled the overnight gap down that is even more obviously the next target area. ES Jun 60min chart:

I said the same on NQ and again looking for that retest with a likely looking fail not far above. NQ Jun 60min chart:

TF was the minority report chart this morning, with a very decent looking double top target in the 1090 area. Sometimes though a double top will turn out to be a bull flag forming and I think this is one of those. TF Jun 60min chart:

In essence we have been following the retrace then high retest scenario that I laid out yesterday morning, though the way that has been delivered has not been at all friendly, and has been tough to trade. That scenario remains the most likely option for today as long as the SPX 50 hour MA holds as support.

Stan and I are doing the public Chart Chat this month on Sunday 10th April. All are welcome to this free webinar looking at prospects for equity indices, forex, energy, precious metals and bonds, and if you have any interest in whether tradeable instruments go up or down, then I’d suggest that you register and attend. If you read my morning posts just for the razor sharp wit and pretty charts then there will be some of both there too in all probability. 🙂 You can sign up for that here. Everyone have a great weekend.