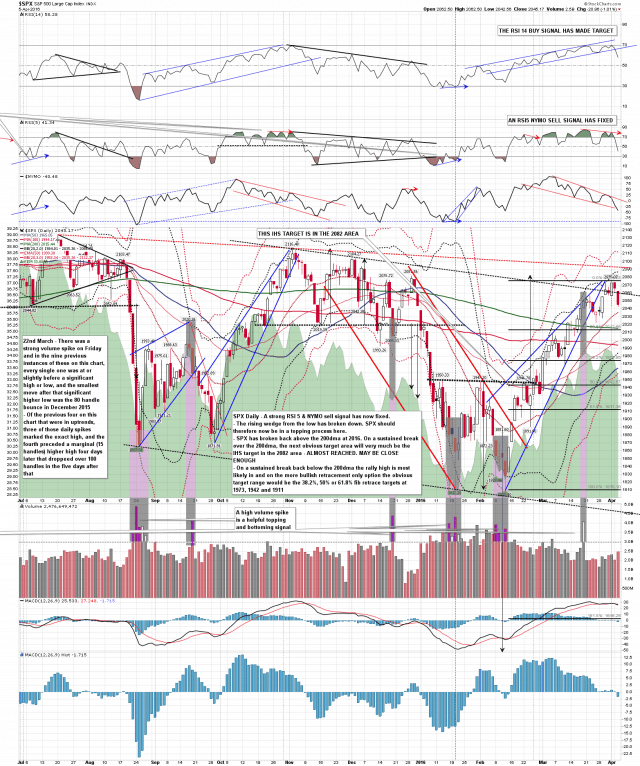

The big news yesterday was that daily RSI 5 sell signals fixed on both SPX and NDX and looking at the overnight action I’m giving 70% odds here that a significant high has now been made. That could be a rally high before a full retracement of the move up from the February low, or it may just be a fib retracement of the rising wedge before another move up. We’ll see. The fib retrace targets are listed on the chart below. SPX daily chart:

So why am I talking about mixed signals today? Well I had 60min buy signals fix on ES, NQ, TF, SPX (RSI 5) and NDX (RSI 5) yesterday and these may deliver a bounce here before the main decline gets started. There are decent possible H&S right shoulder bounce options that may be playing out. If SPX can recover back over 2065 then we could still see a marginal new high, which is the reason that I have given only 70% odds that the rally high is already in. We’ll see how that goes today. ES Jun 60min chart:

Overall the trend has either turned (70%) or is turning (30%) and I’m looking for more downside into at least a retest of 2000 SPX on a sustained break below yesterday’s lows. Obviously we may well see a rally first that could extend into a new high. Today and tomorrow are both cycle trend days, which means that they have 70% odds of being dominated either by buyers or sellers for most of the day. These do not need to be full trend days but often are, and calling the direction in advance tends to be hard. A good day to be nimble I suspect, and the chances are we will see a decent move of some kind.