About a week ago, I wanted to watch something (out of the corner of my eye, as I often do during my trading day) that wasn’t Bob Ross or one of the movies I’ve seen a thousand times already. I fired up Netflix, and I decided to watch The Smartest Guys in the Room, the Enron story, whose trailer is here:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Into the Weekend

Swing Trade KAR LNKD MEG MMM

Market-Be-Gone

My fellow bloggers are seeing the same thing I’m seeing: people are just leaving the market in droves. Why? Simple. Because hardly anyone can make money consistently in this beast. Just look at the recent activity. Neither bulls nor bears are winning. If you win one day, you lose the next, and vice versa.

I guess I’m semi-grateful that at least OPEX week wasn’t the bullish fiesta that I feared. But as I stand here right now, I’m outlining my first screenplay, because the boredom and insanity of this market action is really starting to get to me, and I need a creative, positive outlet. For once, I’m actually looking forward to the weekend. This market, once again, sucks.

Support and Resistance on Opex Friday

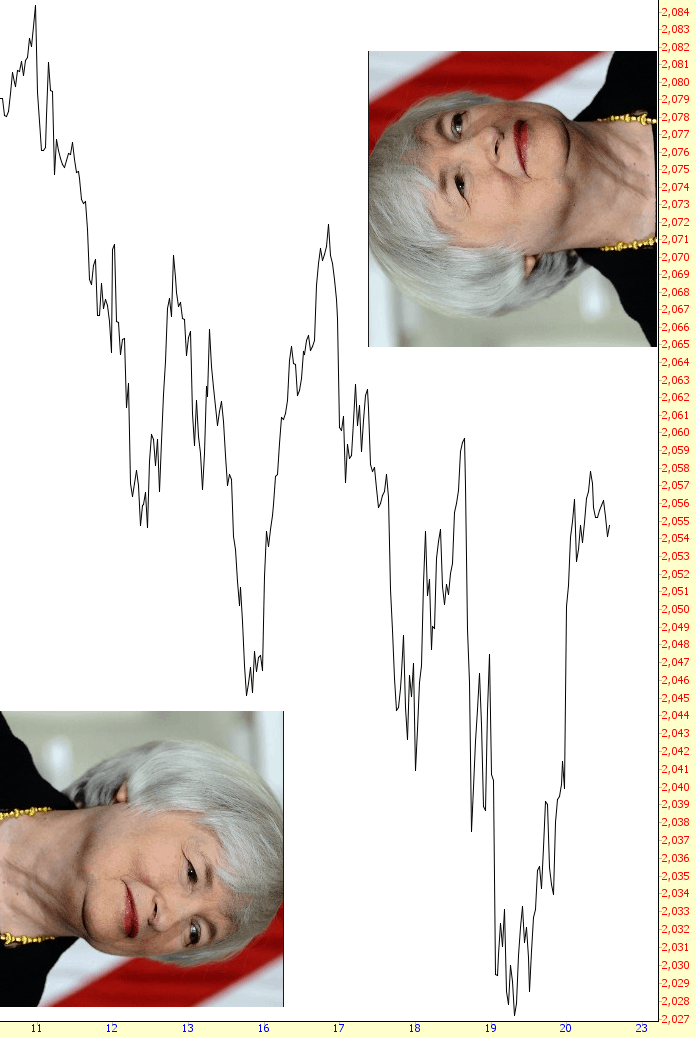

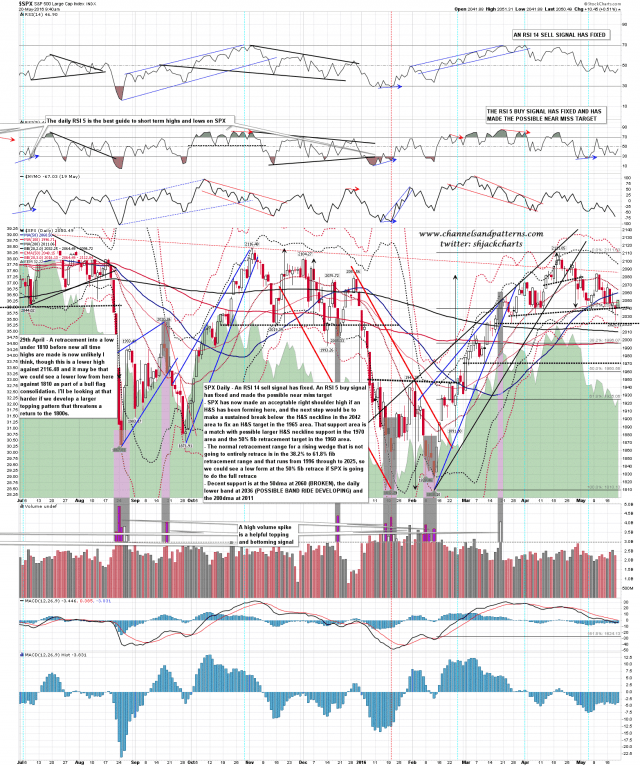

Nice call from Stan on his Wednesday night video when he gave 2024 ES as the support to watch on ES yesterday and, if support was found there, then a likely rally to either the 2041/2 area or a retest of the weekly pivot in the 2053.8 area. I was hoping that ES would just trend down through that support but it was not to be, and ES is currently testing the ES weekly pivot area.

On SPX yesterday was the second day of a possible lower band ride. If that is to continue then the overnight rally needs to be reversed and the daily lower band, currently at 2033 SPX, need to be hit at some point today. Support is there and at the 200dma at 2011. Resistance is at the 5dma at 2050, the 50 hour MA at 2056, the 50dma at 2060 and the daily middle band at 2065. SPX daily chart: