Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Your Candidates for First Spouse

Fear Not Gold Bugs, Gold Ratios Well Intact

What has been going on since mid-February is a burst of the ‘inflation trade’ as evidenced by silver’s leadership in the precious metals sector. This opened the barn door for all kinds of inflated animals to flee into the light of day, and for commodity and inflation boosters to do their thing. As often happens with silver, things were pushed to and even through their limits. Silver went up, oil went up, base metals went up and stocks went up.

But what we should do is retire back to some of the things that actually indicated bullish for the gold sector well before the mini hysteria (and market relief) cropped up. A pullback/correction in gold stocks would be an opportunity.

Gold vs. Silver took a real hit and now is bouncing, unsurprisingly as USD makes a final support bounce attempt of its own. (more…)

Swing Trading RHT SONC AL AAPL YELP

Mixed Bag

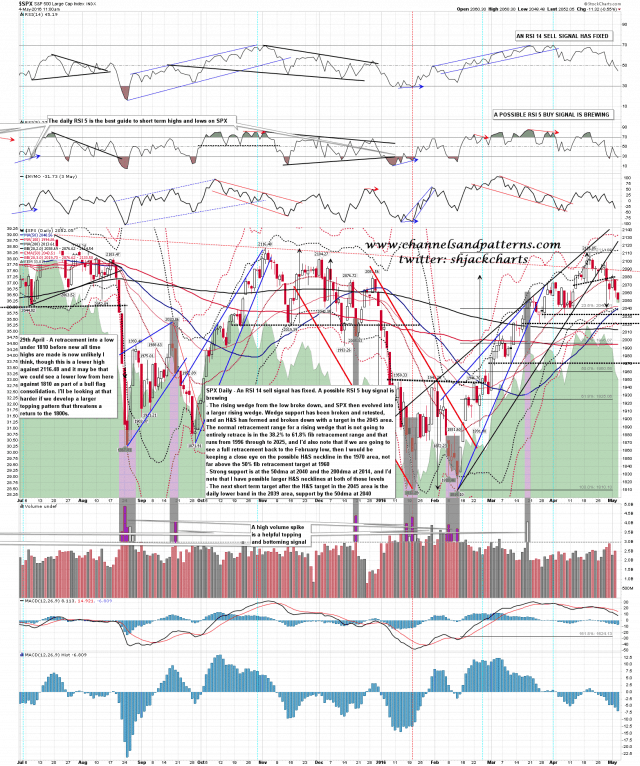

On the SPX daily chart the setup here is straightforward. The current SPX low is at 2047, very close to the H&S target at 2045. As the daily middle band has been converted to resistance the daily lower band is now a solid target at 2039, and that is supported by the 50dma at 2040. A break below these opens lower targets. SPX daily chart:

A possible 60min buy signal is brewing on ES, which is a concern for bears here. One was also brewing on TF at the time I capped this chart and that has now fixed. ES is stalled at 2040 at the moment and I’m wondering if that might hold. The top priority for bears today is to break that and convert it to resistance. ES Jun 60min chart:

I’m not much on trading correlations but I was struck by two other charts this morning that could favor bulls today. The first is CL, which broke declining resistance this morning after establishing a rising wedge turned channel. That channel support is now close to being retested at 43.5, but if that holds then the current retracement on CL is likely over, and CL has been trading with a strong positive correlation to ES in recent days. CL Jun 60min chart:

My other concern here is ZB, which has been trading inversely correlated to ES in recent days, as it often does. ZB is testing bear flag resistance and that resistance has not yet broken, though ZB hasn’t yet broken down decisively from it as yet either. If CL breaks up hard and ZB breaks down hard here then that might be a tough headwind for bears to push through. ZB Jun 60min chart:

There is obvious support on SPX in the 2039 to 2045 area. Bears need to break down through that and convert it to support here or the possible double bottom setups here might deliver a strong rally.