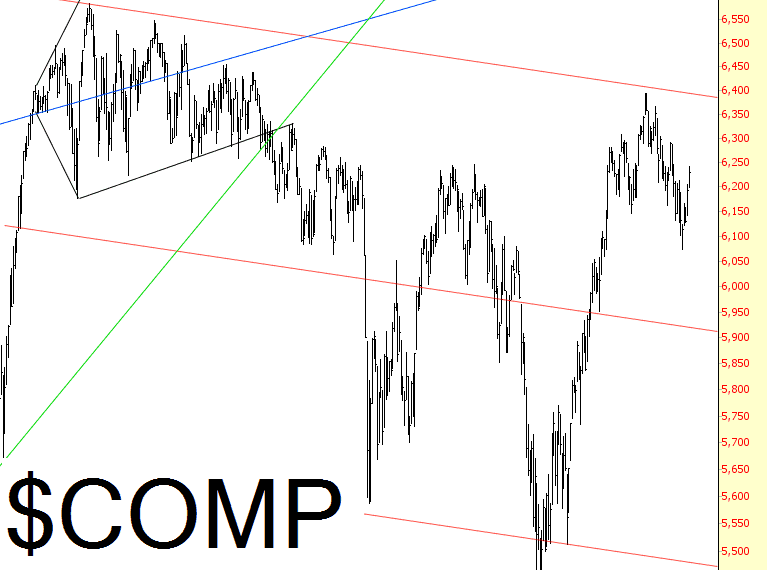

As much as I’d love to pretend things are just hunky-dory, they’re not. This market has (for me, at least) really been a nightmare lately. The big picture bear tops aren’t broken (yet!) but after last Thursday, the bulls have been gaining power and momentum.

Looking at the Dow Composite, the descending channel is still completely intact, and all the up and down action over the past couple of months may ultimately turn out to be nothing more than just another pattern-within-a-pattern in the context of a generally descending market.