Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Heart of our Patron Saint

Our patron saint George Carlin’s wife, Brenda Carlin, died in 1997. They had been married 36 years, and they had a daughter, Kelly. After the 9/11 tragedy, George wrote the following, which I think shows a side of him most people didn’t know existed in such nuance:

The paradox of our time in history is that we have taller buildings but

shorter tempers, wider freeways, but narrower viewpoints. We spend more,

but have less; we buy more, but enjoy less. We have bigger houses and

smaller families, more conveniences, but less time. We have more degrees

but less sense, more knowledge, but less judgment, more experts, yet more

problems, more medicine, but less wellness.

We drink too much, smoke too much, spend too recklessly, laugh too little,

drive too fast, get too angry, stay up too late, get up too tired, read too

little, watch TV too much, and pray too seldom. We have multiplied our

possessions, but reduced our values. We talk too much, love too seldom, and

hate too often.

Did AMAT Chirp? Implications for the Economy and Gold

The following is the opening segment of this week’s Notes From the Rabbit Hole, NFTRH 396. The report also covers, in detail, the technical status of US/Global stock markets, precious metals, commodities, currencies and even a few individual gold miners and a couple of new (non-gold related) NFTRH+ trade ideas.

In January of 2013 we noted that the “Canary’s Canary” chirped and signaled an economic up phase (such as it was) on the horizon. The Canary was the Semiconductor sector, which is cyclical and economically sensitive. The Canary’s Canary is the Semi Equipment sector, manned by the likes of Applied Materials and Lam Research.

Swing Trade IR WYNN ETN DFS CTXS

An Inflection Area

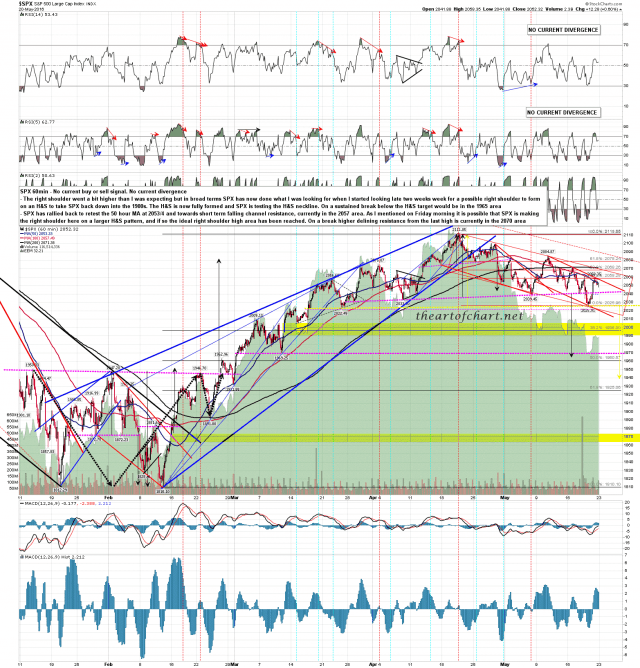

Decent rally on Friday that has failed so far either to make a higher high or to break over the 50 hour MA on SPX, so unless that changes I’d expect the rally to be reversed in the near future, and that may well happen. There is a possible alternate scenario here where SPX might be forming the H&S on a larger and flatter H&S pattern, and if so the ideal high would be a bit higher in the 2075 area. That would be very close to the 61.8% fib retracement of the decline from the highs so far and is obviously still potentially in play. Stan’s bull/bear line is the 2039 ES area (approx 2043/4 SPX) so I’ll be watching that area for possible support this morning.

The short term pattern on SPX is a decent falling channel and channel resistance hasn’t been tested yet. A lower high under Friday’s high could deliver that this morning and we may well see that. SPX 60min chart: