What I had planned on doing this afternoon was a post of about a dozen terrific energy-related stocks that are good short candidates, but ProphetCharts is almost unusable at the moment. I only managed to get one chart out of it before it stopped fetching them. I sometimes feel like I’ve allowed my child to be adopted, and when I run into the youngster a few years later, it’s become a juvenile delinquent. Sad.

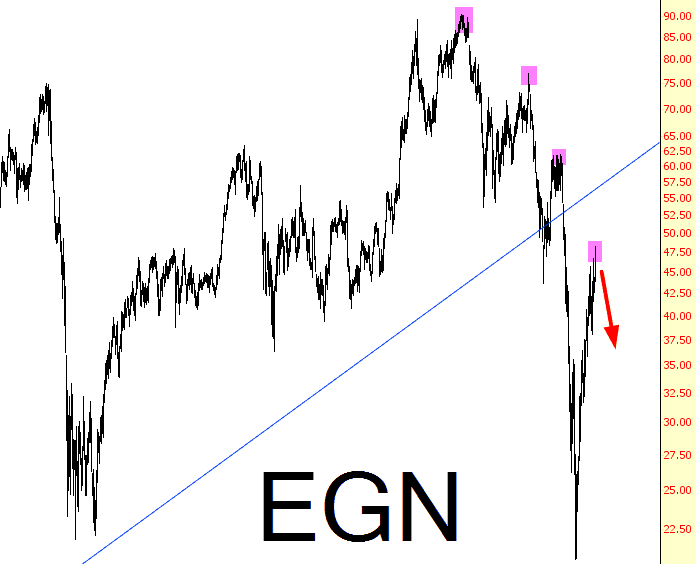

Anyway, the one chart I managed to fetch before ProphetCharts starting puking all over its data servers was Energen, shown below. It’s very typical of energy stocks these days:

(a) a former smooth run-up;

(b) a clean series of lower highs, separated by violent V-shaped recoveries

(c) its current price is, shall we say, lofty in relation to its history as a whole.