“Well, yes, this is just the sort of blinkered philistine pig-ignorance I’ve come to expect from you non-creative garbage. You sit there on your loathsome spotty behinds squeezing blackheads, not caring a tinker’s cuss for the struggling artist. You excrement! You whining hypocritical toadies with your colour TV sets and your Tony Jacklin golf clubs and your bleeding masonic secret handshakes. You wouldn’t let me join, would you, you blackballing bastards. Well I wouldn’t become a Freemason now if you went down on your lousy stinking knees and begged me!” – MPFC Architect Sketch

Earlier today, I saw in the comments section someone mentioned they were going to “BTFD” and that doing so for month after month was “boring”. Well, yeah, they were right (again), because the market…….for absolutely no reason at all………..chugged higher. I’m not feeling that grouchy about it since I’m so focused on energy shorts, and those took most of the sting out.

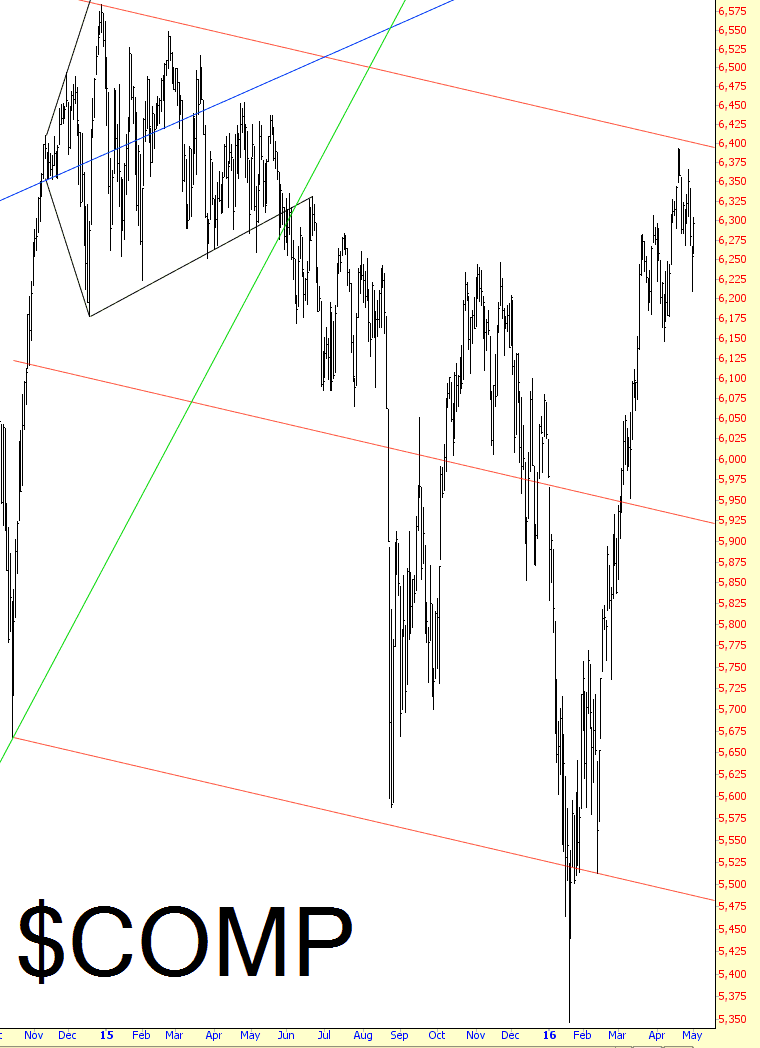

All the same, I think the kind of over-the-top arrogance which leads one to believe that they, in perpetuity, can simply buy any dip and profit later is yet another sign that the market is, shall we say, priced for perfection. I’m going to keep the words to a minimum and ask you to drink in these broad index charts and try to convince yourself that they are screaming “buy.” Here’s the Dow Jones Composite: