This has been a very tense week. The persistent tug-of-war between good (the bears) and evil (the bulls) has been worse than ever, with neither side gaining a toehold. Today (Wednesday), however, helped the bearish cause in a couple of ways.

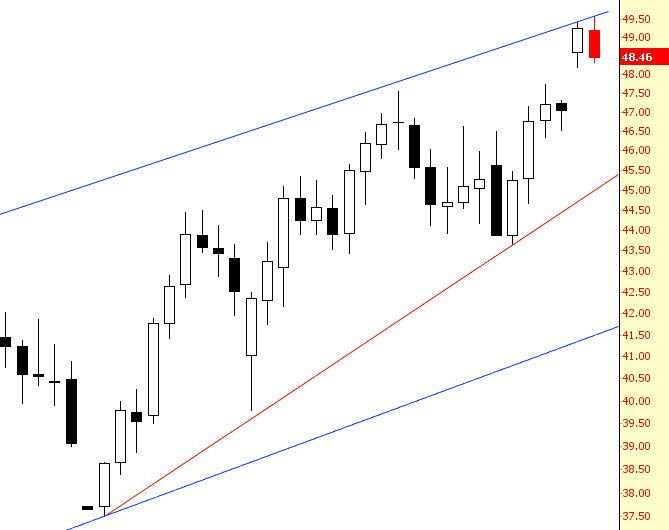

First off, the all-important crude oil bounced perfectly off the upper trendline of its wedge pattern. This is the only reason I made a decent profit today, because my positions are so prone to movement in crude oil. The weaker this gets, the better things go for the bears. Oil is crucial.