Nice call from Stan on his Wednesday night video when he gave 2024 ES as the support to watch on ES yesterday and, if support was found there, then a likely rally to either the 2041/2 area or a retest of the weekly pivot in the 2053.8 area. I was hoping that ES would just trend down through that support but it was not to be, and ES is currently testing the ES weekly pivot area.

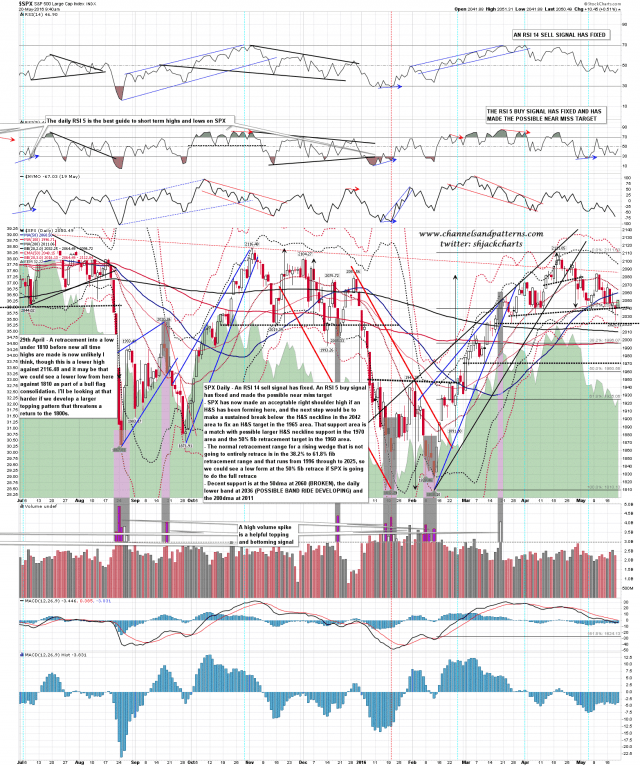

On SPX yesterday was the second day of a possible lower band ride. If that is to continue then the overnight rally needs to be reversed and the daily lower band, currently at 2033 SPX, need to be hit at some point today. Support is there and at the 200dma at 2011. Resistance is at the 5dma at 2050, the 50 hour MA at 2056, the 50dma at 2060 and the daily middle band at 2065. SPX daily chart:

Is there a bullish scenario here? Of course, the market can always go the other way and, if we were to see a break back up over the daily middle band at any point that was not reversed the next day then, the upside would open up. That doesn’t seem particularly likely here but I would note that I have possible scenarios on both ES and TF here where the current H&S patterns might be evolving into larger H&S patterns with more horizontal necklines, and if this AM high this morning doesn’t die then that might well be in play here. ES Jun 60min chart:

TF Jun 60min chart:

As I was saying yesterday morning, one of yesterday or today was likely to be a trend day and obviously that didn’t happen yesterday. Main resistance on ES here is the weekly pivot at 2053.8 and if bulls can break that and convert it to support then we could trend up today. If we see a strong rejection at this test then equally SPX & ES may well trend down for the remainder of the day.

Everyone have a great weekend 🙂