From my morning paper…….mercifully, no injuries were reported.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

He’ll Bring Them Inflation

I used to make fun of the FOMC rate hike “decision” language in the mainstream media because under the Obama administration and its economic policies overseen by the Fed’s monetary policy, there really was no decision, was there? It was ZIRP-eternity, interrupted by a lone and token rate hike in December 2015 (the Dec. 2016 hike does not count because the transition to a new administration and policy regime was already known; in effect, the Fed has already made its first hike under Trump).

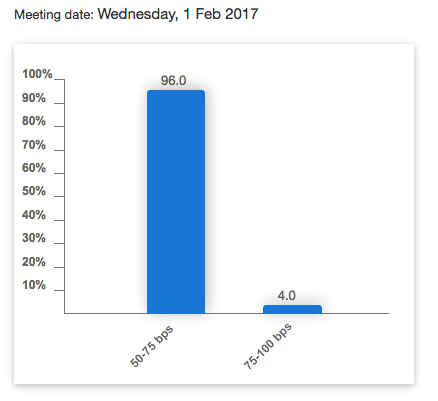

According to the traders who make up the Fed Funds futures, there is no decision tomorrow, either. From CME Group, we have virtually no one predicting two successive rate hikes.

Ending Diagonal Established on SPX

Our primary scenario here is that this is likely to be the last retracement before a likely swing high to be made over the next few days. At the moment that’s looking pretty good, with the retracement low at rising support from the 2233 and the low this morning has confirmed a rising wedge on SPX for this current move, and a rising channel on ES. On a break back over the 50 hour MA on SPX, currently at 2281, there would be a double bottom breaking up with a target in effect at the all time high. We’d be looking for a rejection at that retest in the second high of a double top looking for a return to the possible H&S neckline at 2233, or continuation up to rising wedge resistance, ideally to be hit in the 2310-20 area within a week or so. We’re favoring the higher scenario at the moment. This rising wedge on SPX is of course also an Elliot Wave ending diagonal, which is the ideal pattern to finish this move up.

U.S. Congress: Focus on Economy NOT Political Obstruction

Economic data released today on the Chicago PMI (Purchasing Manager’s Index) shows how much the U.S. economy is urgently in need of fiscal stimulation.

With barely a whimper above the 50 expansion level, the health of its economy is set to drop into contraction territory soon (as it did in 2009 following the depressed signals forecast by similar low numbers produced in 2007/08), unless Congress begins to cooperate and focus on real issues that support its claims of being number one in the world arena when it comes to economic (and military) might, instead of playing economically dangerous political games in unnecessarily obstructing the advancement of the new Trump administration, cabinet confirmations, and economic and security agendas.