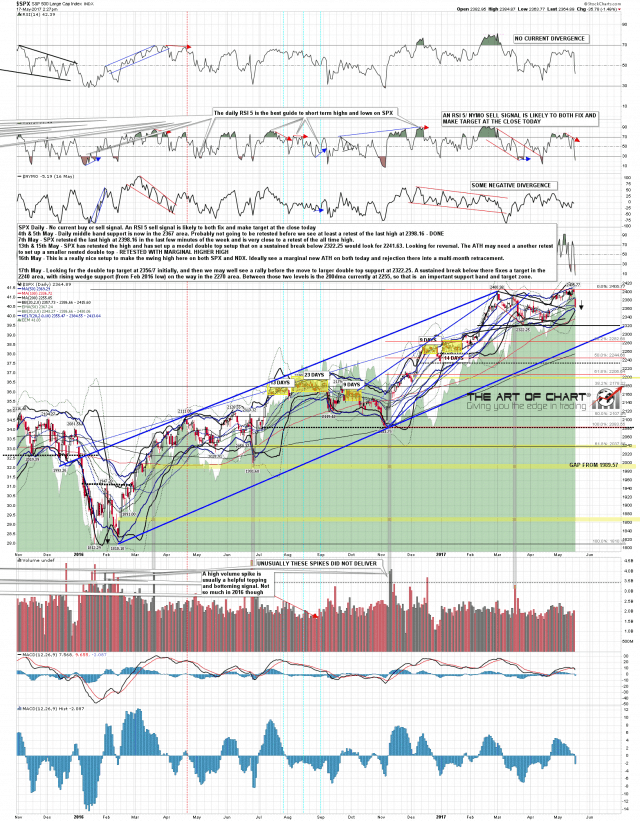

Yesterday’s call for a marginal higher high and rejection worked out ok (buffs fingernails modestly) , even if yesterday afternoon was seriously dull. So now what? Well the first double top target on SPX at 2356/7 has not yet quite been made and that should be tested either this afternoon or tomorrow before we see a likely rally from that area. After that we are looking for a move that should test main double top support at 2322. More details on target areas and support on the charts below. SPX daily chart:

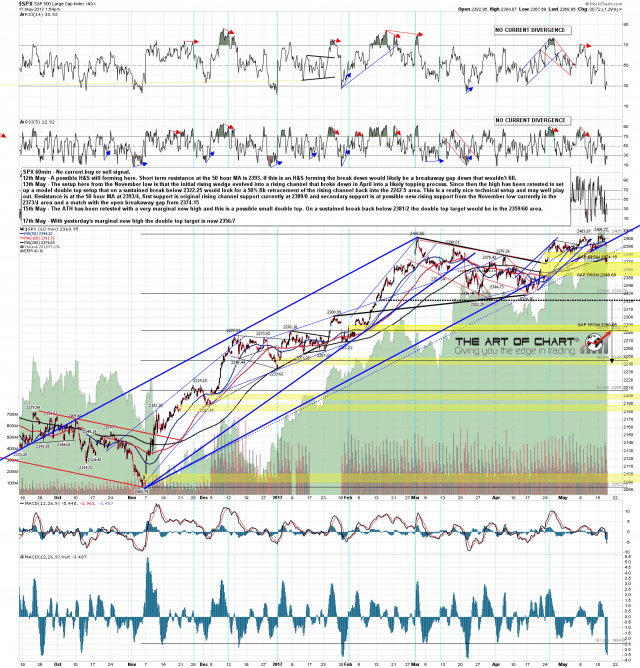

SPX 60min chart:

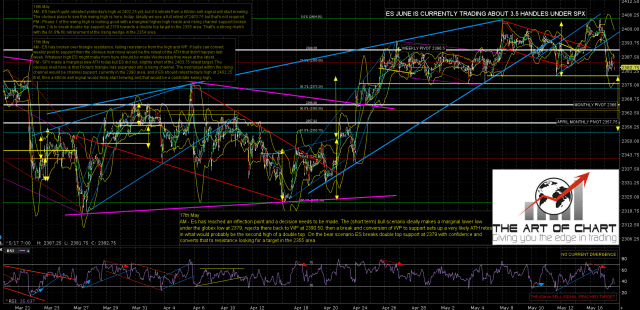

The ES and NQ futures charts below were done before the open for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

The ES low today was just three handles above the double top target at 2355. That’s a strong match with the target on SPX and I’m expecting that target to be reached. ES Jun 60min chart:

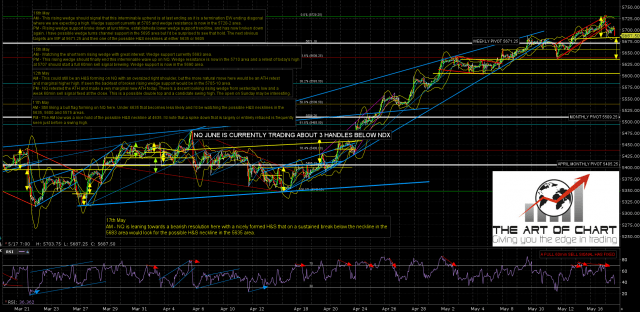

NQ made the H&S target at 5635 and then some. NQ was the weakest of these three indices today. NQ Jun 60min chart:

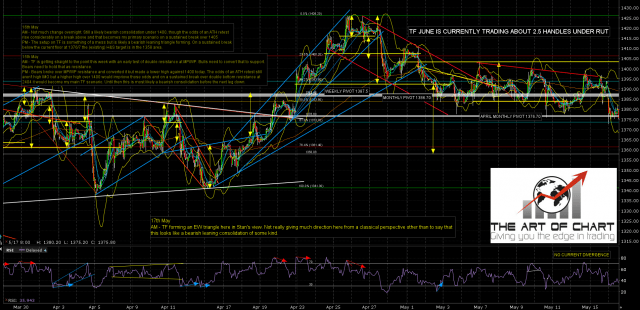

TF made the H&S target at 1358. TF Jun 60min chart:

Stan’s target zone on ES is 2350-5 and we are expecting to see a rally from there. 60min buy signals are already brewing on ES and NQ. What I would add though is that there is important gap support from 2348.69, and if that should fill on an opening gap down, then that may be a breakaway gap that wouldn’t be filled for a while. I’ll be watching that carefully.

Obviously it’s too soon to tell whether these highs will be the several month highs that we are looking for here, but this is a very promising start. Time will tell as always.

Stan and I are doing a free public webinar at theartofchart.net an hour after the close tomorrow looking at our Big Five Service stocks (AAPL, AMZN, FB, NFLX, TSLA), and if you’d like to attend then you can register for that on our May Free Webinars page. I would also note that this week’s edition of The Weekly Call is posted and that the model portfolio there is up 167% over the last six months, looking well on course to make our target minimum 200% return over the first year. That’s a free weekly service and if you trade futures I’d suggest adding it to your reading list.