The daily middle band is a, and perhaps the, classic place for a bear move rally to fail, and after three days of failing to break above the SPX daily middle band this rally failed there into today’s solid trend down day.

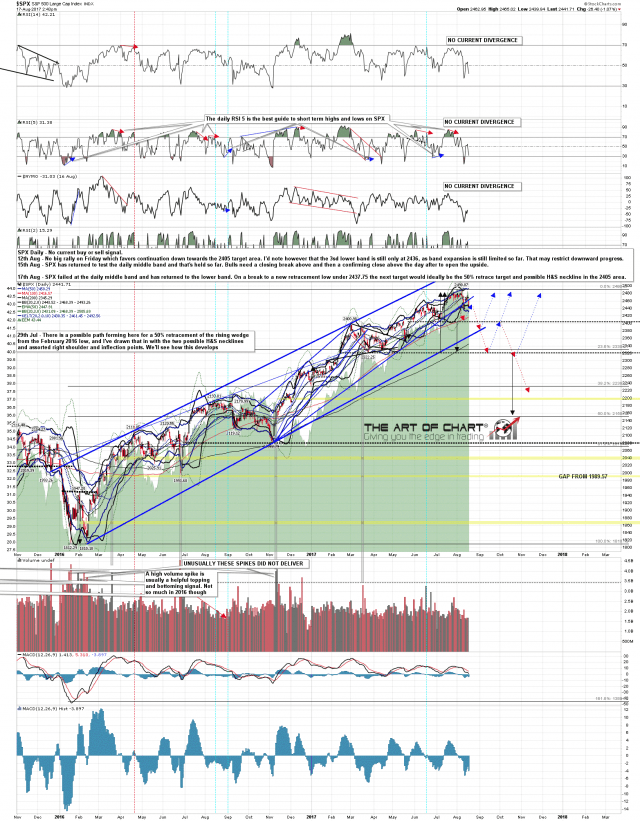

Since I capped the SPX chart below SPX has delivered a new retracement low. I’d like to see a move down to the 2405 area next to follow the path that I sketched in on the SPX chart at the end of July. Ideally SPX would then backtest 2450, possibly hitting the daily lower band at a lower level there, and then decline to the 2320 area, very possibly making the main retracement low there and setting up a solid dip buy opportunity into the end of the year. SPX daily chart:

NDX has now made a new retracement low as well and I still have a larger target back in the 5700 area from NQ, though I’ll be watching the gap area not far above for possible support. NDX daily chart:

The ES, NQ and TF futures charts below were done an hour before the RTH open for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

ES made the double top target I gave before the open this morning and kept going. Nice classic reversal. ES Sep 60min chart:

NQ made the double top target there and kept going. The new retracement low keeps open the 5710 target on NQ, though it isn’t as strong a target as the H&S target on TF. NQ Sep 60min chart:

On TF the first H&S target at 1359 has been reached. The larger H&S target in the 1348 area should be reached soon. Might see a rally first. TF Sep 60min chart:

There’s a lot of talk about the bearpocalypse starting here, but I see fibonacci pullbacks as a sign of a degree of market health. Personally I have made no changes to the proportion of my holdings invested in baked beans and bullets, and I would suggest that it’s perhaps a little early to be gathering on mountain tops waiting for the end of all things. That said, I think the odds do favor more downside on equity indices in the next few weeks. 🙂