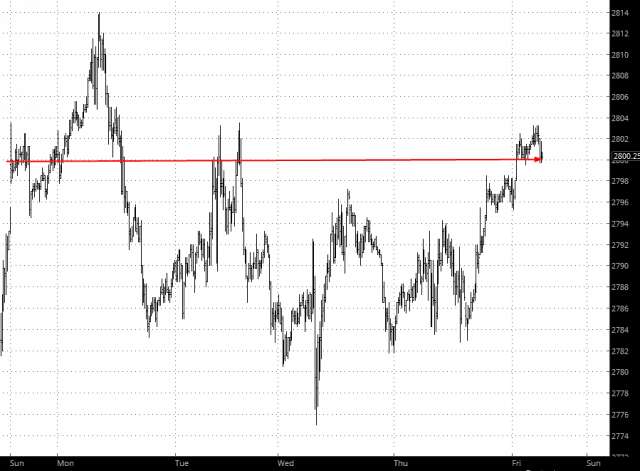

Up a little. Down a little. Up. Down. Round and around. Just look at the week below. We are where we began. Kind of a grind, ain’t it?

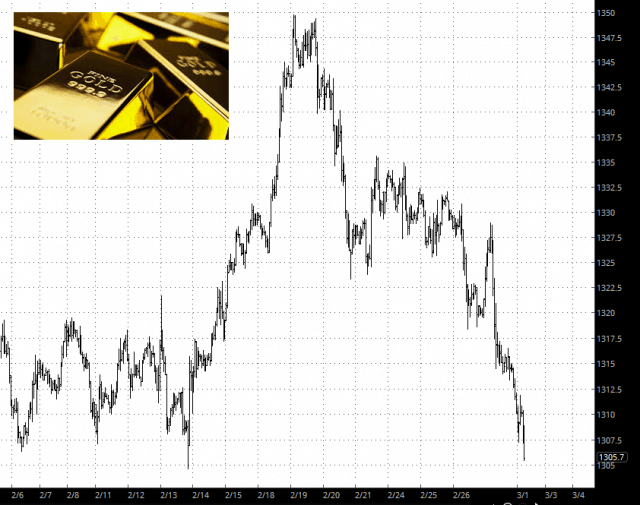

There is some dynamism in other places, though, although not necessarily to the public’s liking. Gold had a terrific run a couple weeks back, zipping $50 per ounce higher. Well, it’s zipped right back. The notion of gold as a barometer of public fear and geopolitical uncertainty must imply that everything is peaches ‘n’ cream on earth now. What with the historic North Korean peace deal and all.

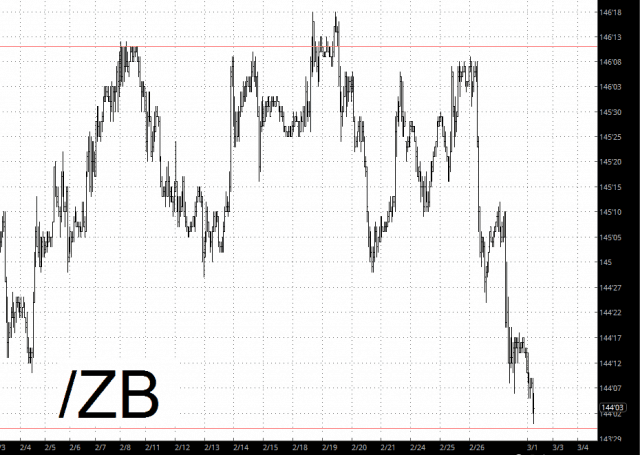

Another curiosity is the world of bonds and, therefore, interest rates. the zeitgeist seems to be that the inching-up of interest rates was not out of fashion. You wouldn’t know it, looking at bonds. These have been getting increasingly weak (back to the levels of three full months ago. People seem to think interest rates are strictly a measurement of consumer confidence, but it might just be that investors are demanded higher interest rates from bonds that aren’t perceived as completely risk-free as they used to be.

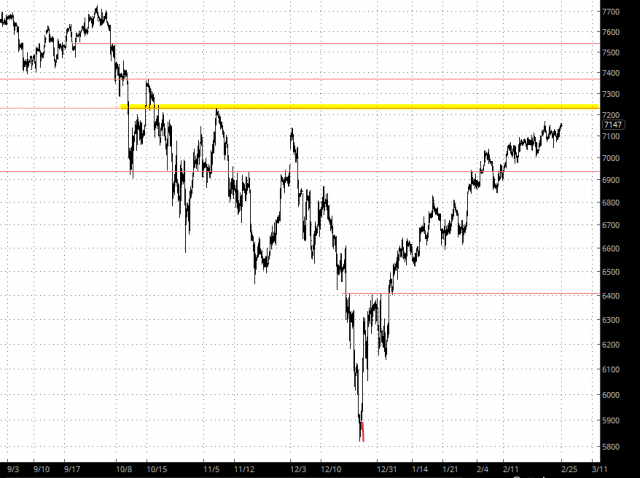

The big picture remains unchanged. The red-hot momentum from the start of the year has sputtered to a state of near-equilibrium, as we bob just beneath the major resistance level that has been in place for the past five months.