Submitted by: The Director. In this post, let’s look at some pre-earnings trades.

First let’s look at CRM (SalesForce). Earnings are June 4th, 2019.

Let’s work on identifying our edge. Using some of my own methods, I’ve first found a “sweet spot” at entering the trade nine days before, and exiting 3 days before earnings.

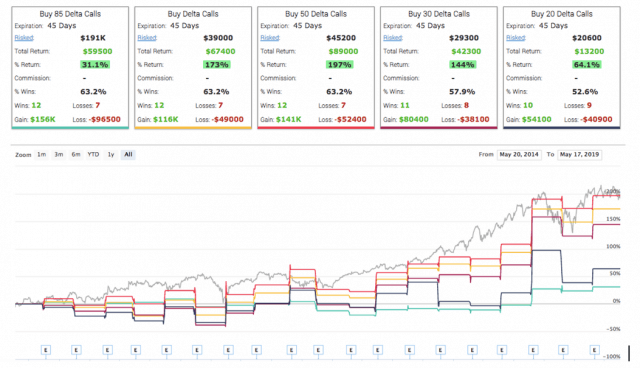

In CML Trademachine, we have seen pre-earnings optimism contribute to just under 200% in profits with a long call strategy [see below] from days -9 to -3 prior to earnings.

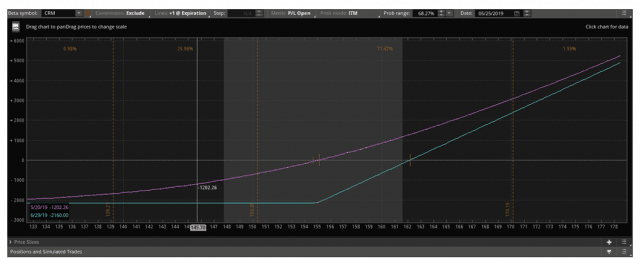

I’ll buy to open the $155 strike [at the money] June 28th 2019 calls. Three calls have a maximum loss of $2160, appropriate risk of 2% in a $100,000 account.

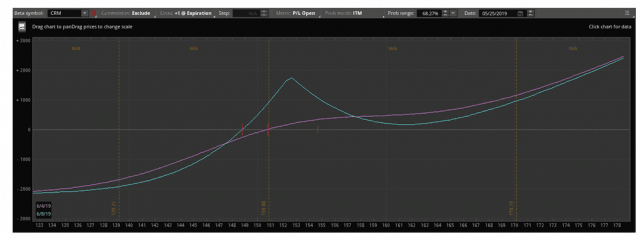

As an alternative, we can combine a ratio trade with an imbalanced calendar to create a high probability of profit with limited risk.

For an imbalanced calendar, we will sell more calls in the front month and buy fewer calls in the back month. Because we have 3 long calls in the 45 day expiry time frame, we still will be net long, and so have limited risk.

Let’s sell to open 10 of the June 7th 152.5 strike calls, and buy to open 9 of June 14th 152.5 strike calls.

And voila, we have a profitable range from 150.77 and up, with an over 62% chance of profit based on the standard distribution alone. We profit if the price goes up, stays the same, or slightly goes down.

We also know we have about a 63% chance of the price going higher with CMLViz, so this overall is a very high probability trade, likely exceeding 80%.

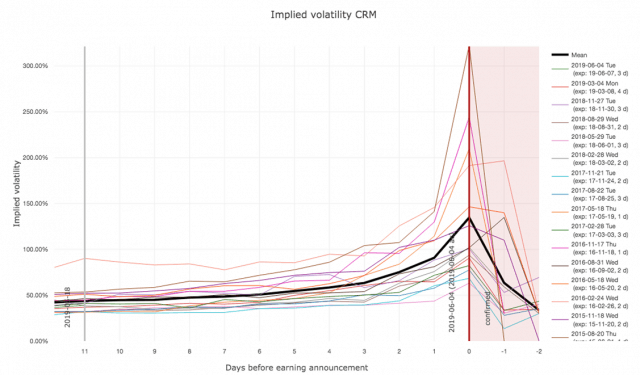

Implied volatility in CRM also increases steadily up to earnings.

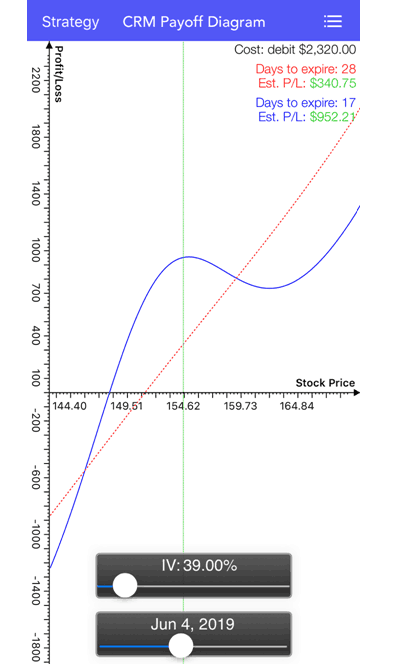

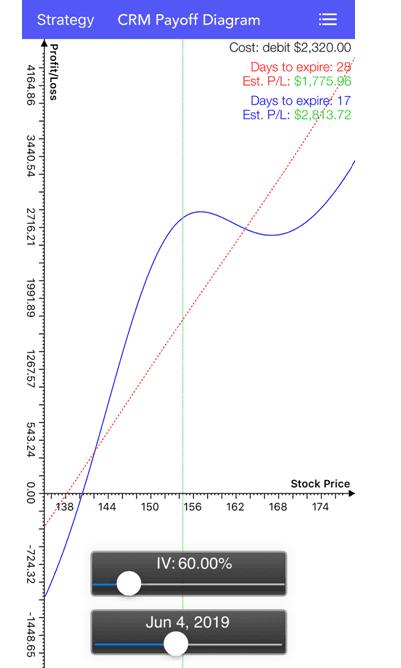

Volatility dramatically improves the likelihood of profit. The first chart shows the current volatility of 39%, and the second shows volatility at 60% which is the mean volatility at T-3.

Increased volatility will dramatically help the trade, and time does not have a large impact on the trade pre-earnings.