Well, we’ve gone from the ridiculous to the sublime. At the midst of the China/US negotiation insanity, the latest gambit by the U.S. is to increase tariffs (literally hours away at this point) but NOT on goods already in transit. Evidently, this gives them a few more weeks of breathing room as the cargo vessels groan their way over the Pacific.

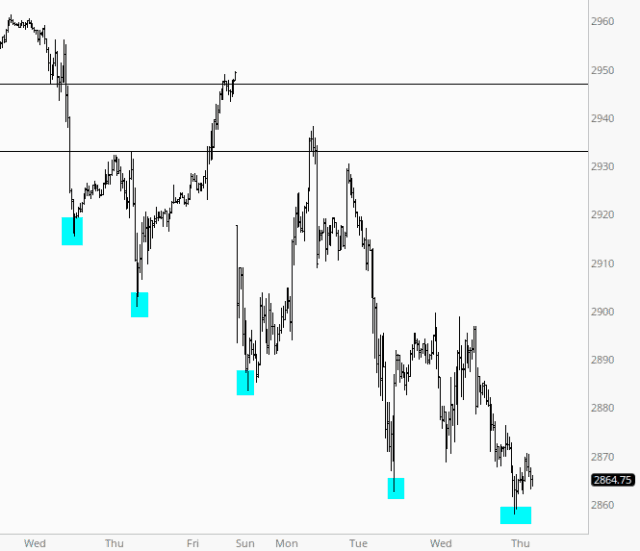

I daresay the next ploy will be to demand the ships cut their speed to 5 knots so that even more time is allowed. It’s all become a comic farce at this point. We’ve only had three days of trading so far this week, but it feels like a month or two.

To my mind, there is a persistent “surprise premium” built into the bid side of the trading ledger. The fact that the Chinese delegation is on our shores leaves open the possibility of some kind of extension in what has been the most annoyingly interminable political drama of the past decade. If the Chinese delegation made an announcement right now that Trump can go straight to hell, and under no circumstances were they going to entertain any deal until after he was out of office, I have a hunch the ES would be a few hundred points lower than it is.

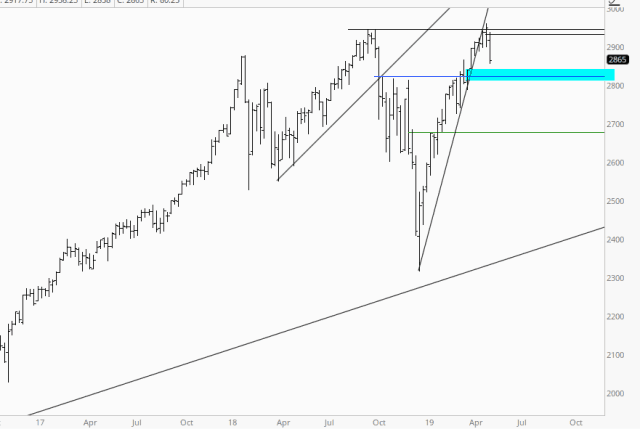

But no such proclamation is forthcoming, and we’re approaching on the ES an important level of support. This was the horizontal that marked the breakout point for the basing pattern. Should this fail, that’ll set us on course for another leg down. After all, I pointed out quite some time ago that the trendline had failed (which was well before the notion of a trade talk breakdown even existed) and, let’s face it, the trendline break really, really mattered, in spite of some of the Doubting Thomases here who don’t believe in such things.

As for my own positioning, it’s been pretty steady all week – – 64 individual short positions and about 200% committed. I’d put the pedal to the metal if I didn’t constantly fear some damned tweet. But I remain too scared.