Before I begin, I wanted to thank everyone who has written me both ideas and congratulations for our new Annual Overlay feature (yes, I’m going to come up with a better name, hopefully one which doesn’t stink). I don’t think I’ve ever received as many ideas for a given feature before. Anyway, on to the green screens……….

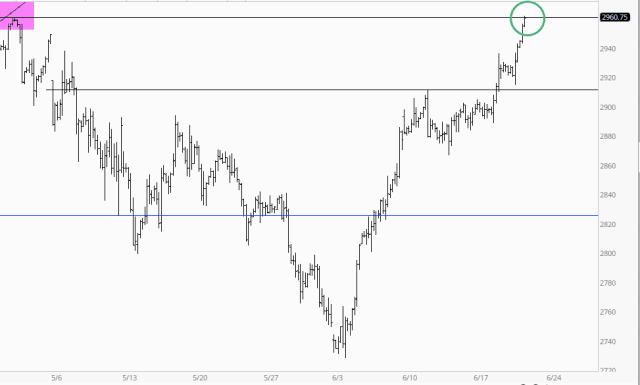

Lifetime highs. That’s what we’re getting on the heels of yesterday’s FOMC announcement and in advance on next week’s G20 summit. Only since June 3, not even three weeks ago, we’re up nearly 2,500 points on the Dow and are busting records left and right.

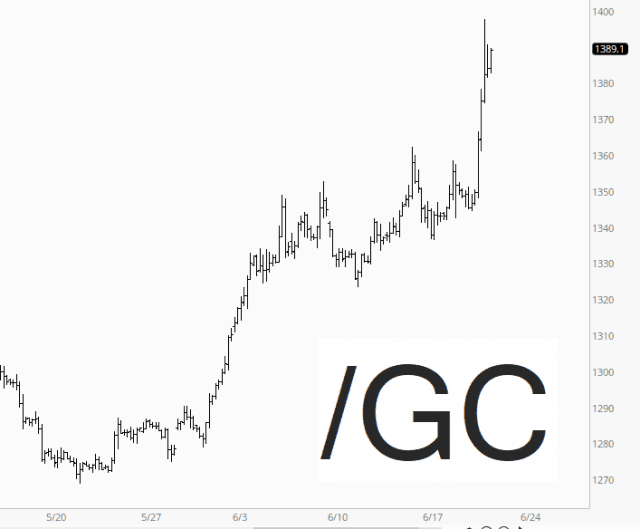

And it’s not that some assets are up at the expense of others. Everything is green including, notably, gold, which is finally getting some real wind in its sails. You’d think it was bitcoin or something!

The NASDAQ isn’t quite there yet, but it certainly seems on its way. It seems hard to believe that only three Mondays ago, this was the same NQ getting slaughtered by direct attacks against Google, Apple, and Facebook from the federal government. Did they cancel all those probes and inquiries after they were announced? It sure is acting that way.

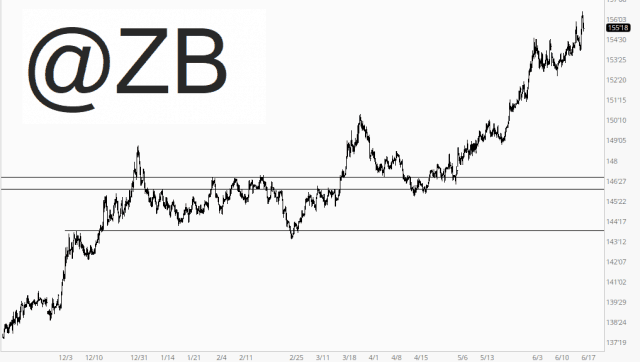

The spurts above are all fairly new. The real stomper continues to be bonds, whose ascent speaks to the collapsing yields around the world (and, in turns, those collapsing yields speak to just how truly weak the global economy is, since it can’t support anything above 0%).

At this point, new highs will most likely keep begetting new highs. The only thing that could put a pause to this buy-fest would be some kind of trade war debacle following the G20 summit. Until then, it’s anyone’s guess. Even ZeroHedge has given up on publishing any kind of bearish doom porn and has wound up churning up the likes of this as their featured bad news.