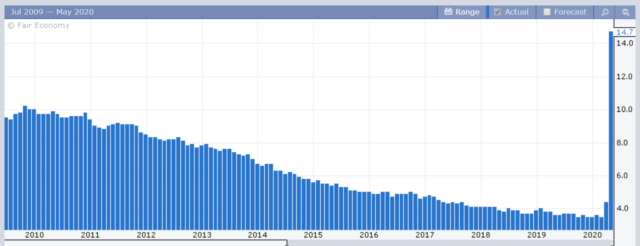

It took an entire decade to drive the unemployment rate from about 10% to the recent 3.5%. It was a slow, arduous, grinding process that took a long time and trillions of dollars in government relief.

And it’s all been undone in the blink of an eye.

Looking at the long-term picture since World War 2, unemployment has tended to cycle between about 3.5% and about 10%, just like the aforementioned decade-long grind. It’s pretty consistent in its regularity for as long as records have been kept. When the good people who manage the Federal Reserve database update the chart below, today’s print will be literally “off the chart”.

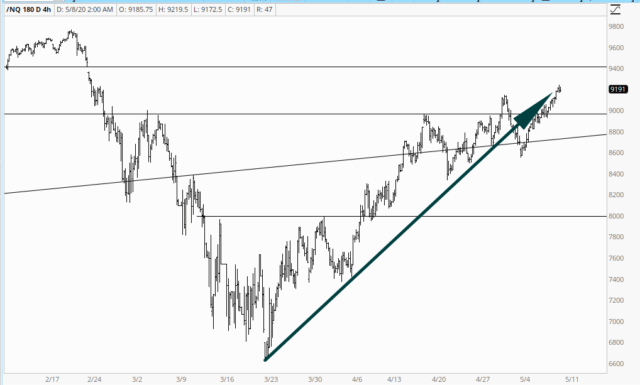

Of course, you’d never know any of this nastiness is going on if you only were looking at equity prices. They are doing fine and dandy, thank you very much. Thanks to Powell’s BRRRRRRRR machine, 7,000 points were slapped onto the Dow 30, and the NASDAQ is actually up for the year and only a few percentage points beneath the highest point in history.

Just as options prices have two components (“intrinsic“, the actual value, if any, and “extrinsic“, the external value from other properties of the instrument), so too do stocks. It didn’t used to be that way. Virtually the entire value of a given stock symbol was the company itself: its products, its management, it profit growth, its prospects, and so on.

These days, I would say the majority – – sin some cases, virtually the entirety – – of a given stock’s price is the exogenous value created by the Fed. It makes this market orders of magnitude more difficult to navigate.