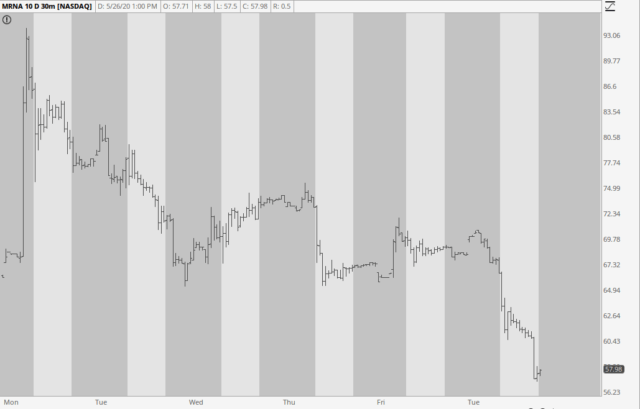

The passivity of the American public is jaw-dropping. Let us reflect briefly on Moderna, which only days ago was trading at $94 due to chatter about how they had cured Covid or some such thing. That very day, insiders dumped $30 million on a naive public and did a huge secondary offering. Here’s the aftermath:

A 40% drop in price in a matter of days. The public gets fleeced once again. And no one has a thing to say about it. Incredible. And you know as well as I do the next drug firm that pulls this is going to be every bit as successful.

As for the market today (Tuesday), small caps were very strong, the S&P 500 was up but not as strong, while the NASDAQ burned off enough of its excitement to actually wind up like this……….

It’s all about the gaps these days, though. As I mentioned in my premium post this morning, both indexes and ETFs have been nailing their price gaps left and right. It’s actually quite remarkable.

I mentioned my “DMC Challenge” this morning, and the end of day results are mildly interesting (but will grow far more so with time). The “Longs” spreadsheet wound up with 11 winners, 14 losers, and an overall change of negative .26%. Now I don’t feel so bad about not buying stocks left and right. Of the 25 hypothetical positions, the only big winners today were TAL and BLDP, with PTON being the biggest loser.

The “most shorted” stocks continue to get aggressively bid, so of the 125 hypothetical shorts, 109 were losers and 16 were winners, and the overall portfolio was down 3.94% on the day.

For “for real” portfolio has been battered into meek submission, with a mere 30 positions (equity shorts) and a feeble commitment level of 65%. The past nine weeks can only be described as horrific and traumatic. I am refraining from discussing what I’d like to see done on national television to Jerome Powell, as it may send readers into a state of shock.

I did have the temerity to purchase IWM July $140 puts today, however, and the timing was pretty good, so they closed the day up 6.1% from my purchase price. Thus, among these 31 positions total, I have 23 winners and 8 losers.

What we witnessed from Feb 20 to Mar 23 was an honest-to-God semi-organic market. And this isn’t just a permabear talking. There were some big “up” spikes during that span of time. But the dynamism actually had some real give-and-take. Not just take-and-take, which is this goddamned Powell market.

It’s causing some people to off off the rails. I see it in the emails I receive. I even saw it by way of Claws deciding to leave the site forever, which was for some reason the most up-voted comment. (He wasn’t upset; he just decided he knew what he needed to know).

Anyway, I’m testing out Slope mobile right now. Back to the laboratory. The Director kindly put a post together, which I’m going to try to assemble as well for publication this evening.