It has been discouraging, to say the least. The small caps have exploded 8% higher since Friday based on………..what?………the promise of yet another miracle cure? Covid ain’t the problem, folks. The economy is rotten to the core, but self-delusion is as popular as disco was in 1977. This is mass hypnosis gone berserk.

But something dawned on me about my beloved small caps. I’ve been so wrapped up in what happened between February 20 and March 23, and what has happened since then, that I failed to open my eyes to the bigger, broader picture. The pattern to watch didn’t start a few weeks ago. It started in early 2018! And it’s a monster.

It is plain to see now that the plunge that terminated on December 26, 2018 (I don’t need to look up these dates; they are burned into my cerebral cortex) was a key first portion of the pattern. It all makes sense now that so much time has passed. And what we’re struggling with now is the ascending trendline from March 23rd, which is the latest piece of this puzzle.

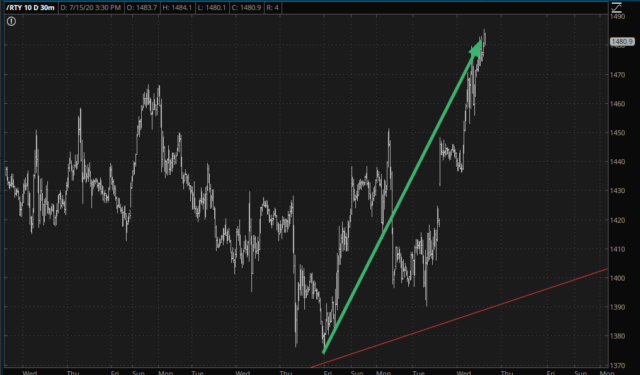

If we can convincingly break that line – – now just fart around with it, but cleanly break it – – we can begin the next phase of this. This is a massively important point right now, however, because the topping pattern as reviewed by the Russell 2000 below is complex, clean, and beautiful.

The risk to the one or two bears still left on the planet besides myself is the red line shown below. Push above it, and you can just hammer the last nail into the ursine coffin.

My woeful countenance, pictured below in stereo, shows how joyous and exuberant I have been feeling. I offer this juxtaposition, however, to prove that after four months of waiting, I finally got my hair cut. Good thing, too, because my barber Tommy was open for literally just a few hours before the Governor shut down all the hair-cutters again indefinitely. Since I hate, hate, hate having long hair, it was probably the best thing that’s happened to me since, oh, March 23rd.

As for my portfolio, to preserve my sanity, I have embraced a complete intolerance for any position with a loss. “If it’s red, it’s dead” has been my motto for weeks.

The consequence of this is that I’ve been retreating farther and farther into a corner. I have a mere 27 short positions now and a puny 74% commitment level. Long gone are the days of mid-March when I was 230% committed and my only lamentation was not holding on for greater profits. What a nice problem to have had.

I would suggest that my utter lack of exposure virtually guarantees a swan-dive in the immediate future, as God gets big lulz that way, evidently.