Okay. We’ve got some ground to cover. First, watch this, if you dare.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Taleb Says It’s Time To Hedge Tail Risk

A few years ago, Nassim Taleb and I followed each other on Twitter, and he was even kind enough to offer his respects on my deadlift PR.

Moving To The Next Screen

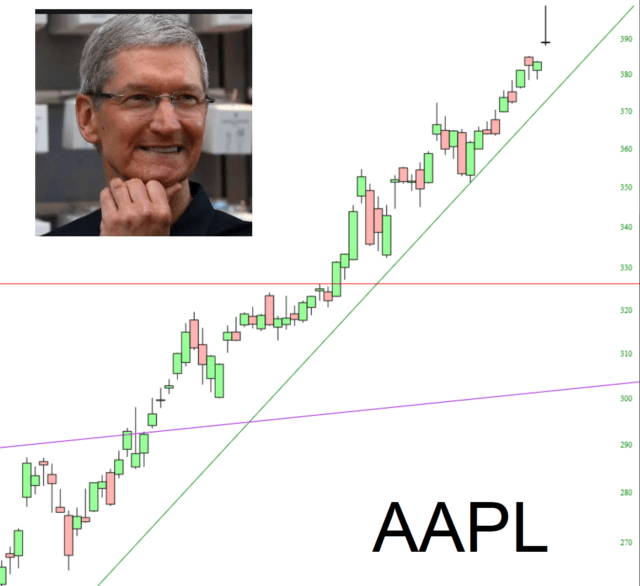

One thing I try to stress in these posts is that the movement of the market can, to a significant extent, be broken down into a series of inflection points and, depending on the outcomes at those inflection points, the market moves to the next inflection point or screen.

Last week there was a very nicely formed inflection point and the decision at that inflection point was made on Friday, with a smaller bull flag channel ultimately breaking up with a target at a retest of the short term high at 3184.15, and a larger bull flag channel also breaking up with a target at a retest of the June high at 3233.13. Both targets have now been reached, with the high today on SPX at a marginal higher high at 3235.32.

Was this good news for bulls? Well not necessarily no, as my bear scenario had a decline ideally into the 2880 area before a likely retest of the June high to set up a possible double top for this move up since the March low. As that retest has been done now instead, that possible double top has been set up earlier and SPX has arrived at this next inflection point.

(more…)Cooking the Books

This month’s blog is a little different — it’s co-written with my friend Marc Rubinstein. Marc is a highly talented analyst, ex Lansdowne Partners anmd writes a terrific blog on banks and financials which you should definitely subscribe to. Marc also is the tutor on our Banks Sector Course. In this blog, where he did all the hard work and write some more elegant prose than is customary in tehse pages, we take a look at Greensill, on paper one of the most valuable fintechs in Europe. What a story! It’s got it all: a Softbank angle, a BaFin angle (remember Wirecard last week?), a human interest angle (farmer turns billionaire) an element of financial engineering, and of course an accounting red flag issue.

New asset classes pop up all the time. Some, like common stocks, hit the big time; others fizzle out. What makes some asset classes durable and others a flash-in-the-pan is an interesting question.

(more…)