Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

No Bell to Be Found

Rot

Numb. That’s what it feels like. Or doesn’t feel like, I suppose. Numb. Not depressed. Not saddened. Just no longer subject to the psychological millstone collectively hanging around the neck of the nation’s psyche. Yet it’s still hard not to fill affected in some way.

On Saturday morning, in a short span of time, I was greeted by a series of realities. The first, known to us all Friday night, was the commutation of the Stone sentence. Let me say at the outset this has nothing to do with politics for me. I’ve always viewed Presidential pardons and commutations that weren’t plainly an act of grace and decency to instead reek of corruption (such as, for instance, Clinton’s pardon of Marc Rich). Let’s face it, Stone is one of the smarmiest looking guys on the planet. This whole thing stinks to high heaven.

(more…)What Are Tail Risk Funds?

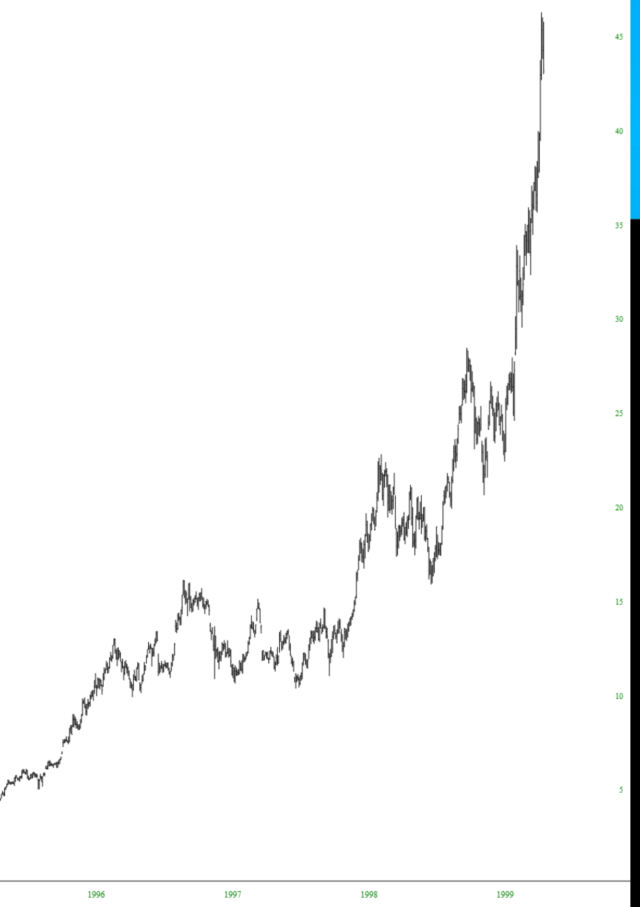

Tail risk funds represent a small niche of the hedge fund industry, and there are a few different types. They essentially serve as insurance for your portfolio. They lose money most of the time, but when there is a tail risk event, they rise quite a bit when the rest of the market crashes down hard and fast.

Tail risk funds hedge against tail risk, which is a type of portfolio risk that appears when there is a significant chance that any particular investment or fund will move more than three standard deviations from the mean. Tail risk events have a small probability of occurring, but they do occur from time to time, which is why many investors choose to use tail risk funds.

Traditional strategies for portfolio management usually follow a pretty normal distribution. There’s nothing out of the ordinary with them. However, tail risk funds are able to normalize the returns of an entire portfolio by making up for steep declines when there is a sudden correction with no warning or time to prepare for it. Such a steep, sudden correction occurred in March 2020, and many tail risk funds made headlines with astonishing returns during the selloff.

(more…)