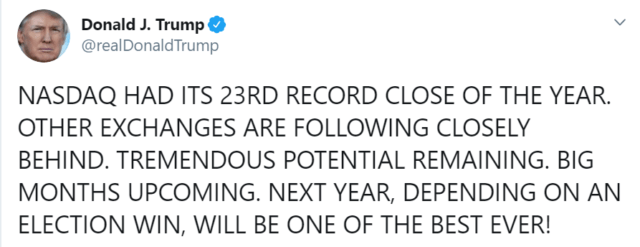

In numerous columns, and years before that, I have been beating one drum. The stock market is forward looking. It attempts to figure out which firms will control the future, Amazon for instance, and which companies have dropped the ball, IBM for instance. There are numerous examples of this dichotomy, but one I have been harping on in numerous columns is the relation between Tesla and the auto industry. It is time for a retrospective.

Checklist For A Successful Electric Car

Back in December of 2019, I wrote, A successful electric car must check four boxes: design (modern tech look), price, range and availability in quantity. Only the Tesla Model 3 (and potentially the forthcoming Model Y) checks all four boxes. The Bolt is boring. The Leaf is ugly. The Polestar is not available in quantity. The i3 is getting long in the tooth and still lacks the range. The Taycan is way too expensive.

The Jaguar and the Audi are large expensive SUVs comparable to Tesla’s Model X. There are other competitors like Fisker, but they produce a few high-priced exotics. Is it any surprise that in the United States the Tesla Model 3 outsells all other electric cars combined?

(more…)