Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Gold and US/China Conflict

In January, progress on the US-China trade deal seemed to calm the trade war between the two countries. However, everything changed when the corona-virus emerged. Since the beginning of the pandemic, demand—and resultant spot price for silver and gold—reached new highs. The stock market fell and rose several times in the hopes and doubts for a vaccine. Although politics and gold bullion might not seem to have much in common, the gold price is inherently tied to political events. After all, it is deemed a safe-haven metal for a reason. So how do current events affect the 9-year high gold price?

Get the entire 10-part series on Ray Dalio in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Three Theoretical Bears

Just to start I want to state a clear health warning for the historical stats I’ll be weighing at the start of this post. This stats can give a useful lean, but even an 80% bullish lean still assumes 20% odds that the market closes higher that day, and this lean in either direction does not carry with it any indication of how far up or down markets might close. That said, as a tool in the technical toolbox these are always worth looking at in my opinion, and often deliver decent results.

In my intraday video on Thursday and my premarket videos on Friday and this morning at theartofchart.net I was looking at the historical stats for those days and for this week and proposing a possible course that SPX might take into the end of this week.

(more…)Specific Options Setups

From our friends at TradeMachine Pro:

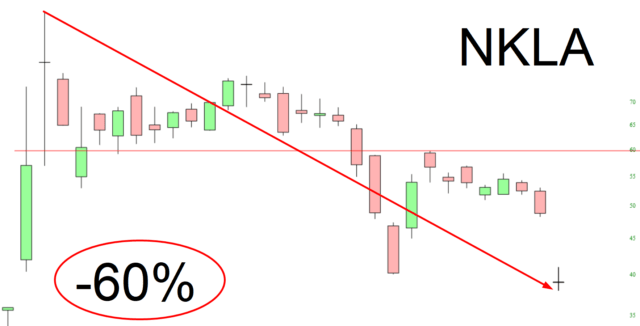

Arrivederci, Nikola

Last week I did a post called Nikola Ready for a Shock, Well, that didn’t take long: