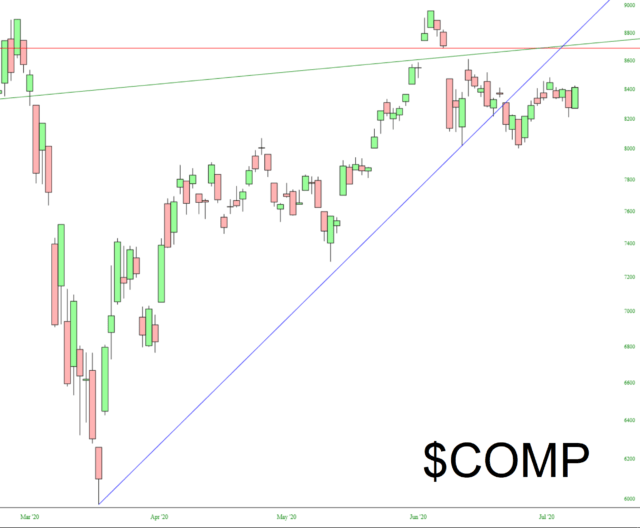

The market just won’t shake itself loose, will it. For weeks now, it feels like we’ve been trapped. Unless you own one of the handful of mega-cap NASDAQ stocks that makes a lifetime high every single day, I suspect you have the same frustration that so many others do.

The source of this frustration can, I believe, be better understood with the equity index charts shown below. We begin with the Dow Jones Composite, which shares the same two fundamental features found on so many other big indexes and ETFs: (1) an important price gap, below which prices have traded for weeks (2) a broken trendline anchored to the March 23rd bottom.