“Like a shot from a dystopian staging of Akhnaten”. Carlos Gonzalez’s striking photo of the August Minneapolis riot.

We Can Strike In Any Direction

A quick follow-up to my previous post, Tortoise Formation. In that post, I analogized Portfolio Armor’s response to Thursday’s market action to an ancient defensive tactic:

In ancient warfare, when hoplites faced an onslaught of arrows, they sometimes sought shelter under each other’s shields in the tortoise formation. You can see a live action enactment of this in the scene from the 2004 film Troy below.

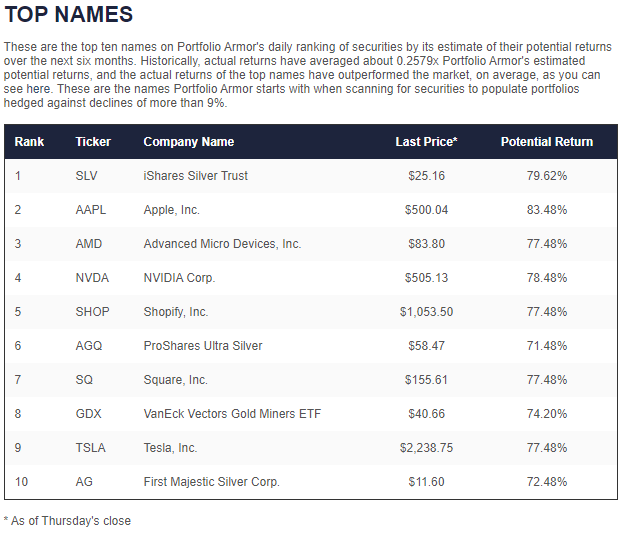

In that post, I noted that our system’s top names don’t usually turnover much on daily or a weekly basis, but Thursday marked an exception. Our gauge of options market sentiment took us from these tech-heavy names on August 27th,

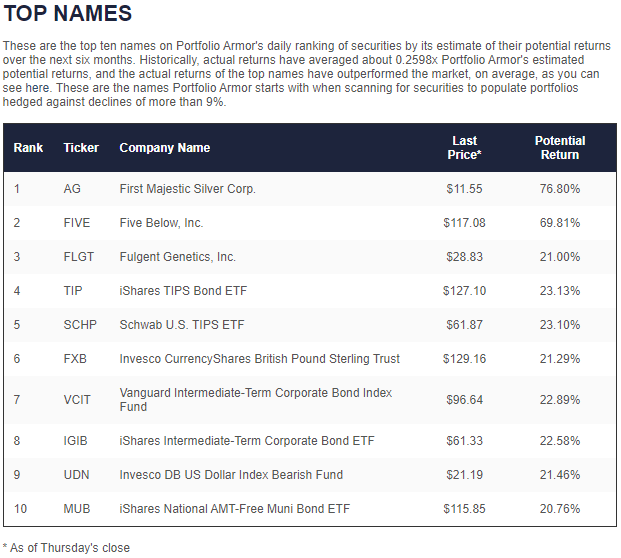

To this “tortoise formation” on September 3rd:

Out were the tech names and in were stodgy inflation-protected fixed income ETFs like TIP and SCHP.

Breaking Out Of The Tortoise Formation

I ended my Tortoise Formation post by noting that our system could strike in any direction:

If you watched the scene from Troy we linked to above, you know Achilles (Brad Pitt) and his myrmidons didn’t stay in the tortoise formation long. They saw an opportunity and went back on offense. I expect Portfolio Armor will do the same soon. With what, we’ll see. Every security with options traded on it in the U.S. – stocks, ETFs, inverse ETFs, ETNs – is a potential spear. We can strike in any direction.

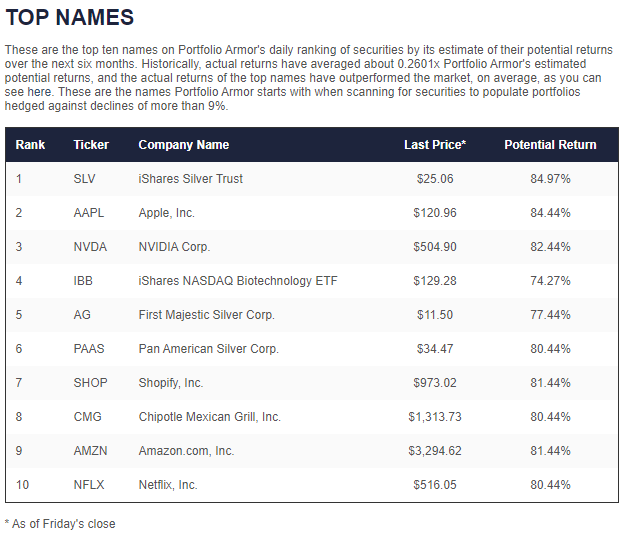

Here’s where it struck after Friday’s market action:

Out were the fixed income names, and back in were tech names like Apple (AAPL), Amazon (AMZN), Nvidia (NVDA), and Shopify (SHOP). One constant across all the top names cohorts above has been silver names, such as SLV and First Majestic (AG) above.

Hold Onto Your Shields

Given all the political and economic uncertainty, hedging is prudent now. I’ll close by showing a couple of ways you can hedge one our current top names, Shopify: