Preface to all five parts: As of Friday’s close, I had fifty open short positions. I have broken these into five equal groups; here is this set:

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Preface to all five parts: As of Friday’s close, I had fifty open short positions. I have broken these into five equal groups; here is this set:

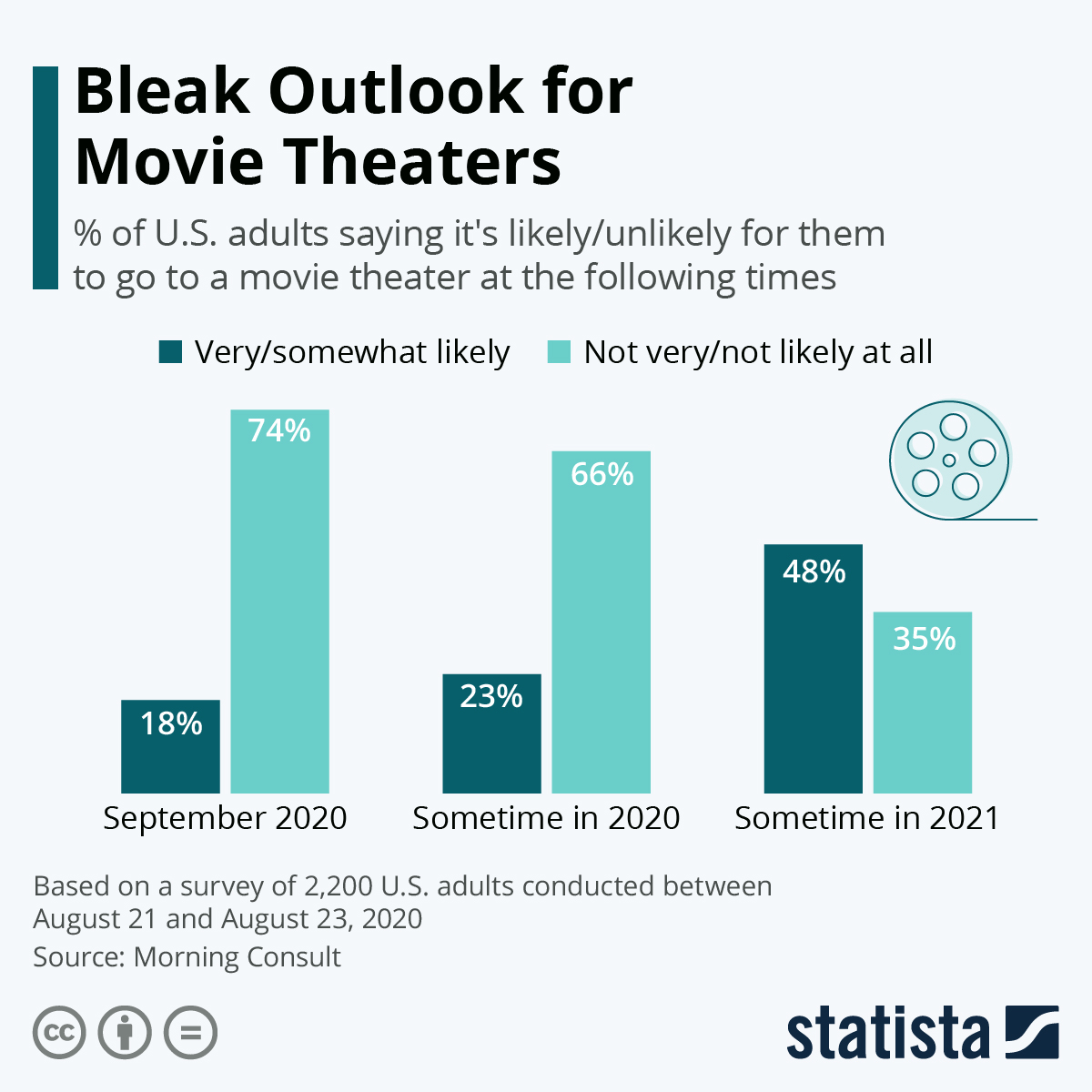

Every time I see a multiplex and its utterly empty parking lot, I marvel at the fact that cinema companies have rebounded so much. Zero revenue, to my mind, isn’t a great business model.

(more…)

(more…) Preface to all five parts: As of Friday’s close, I had fifty open short positions. I have broken these into five equal groups; here is this set:

ATR is a tool in every charting program (including SlopeCharts) that will calculate the most recent average true range of price based from the past 14 time intervals. When transitioning from calm to volatile market conditions, ATR will expand with price volatility. And conversely, it will contract during periods of price contraction.

You can go into the setting of the ATR and increase or decrease its length. I tend to visually look back twenty to 30 intervals manually, (by eye), yet set the ATR to the length 14 intervals. Consider this measure as a tool to measure a decent second target. A 14 interval ATR is specifically based on the interest in a healthy second target in anticipation of price volatility. Yet if price is contracting for more than 14 intervals and about to break out, length 14 will not reflect the most optimal second target price. That is why your eye looks to the left to recognize price potential. At some point, hopefully, you will learn that ATR is similar to training wheels when learning to ride a bike.

(more…)