For me, trading has been an evolution towards ever greater systematisation.

My experience is that reading the charts and picking market direction is emotionally satisfying and financially devastating.

I am part of the species human, and we are a disappointing species. Despite years of moderately successful trading I have an unfortunate tendency to cheer for my trades like they were football teams.

I remember the winners and shove the losers into a dark cavern of my mind, never to be thought of again.

I obsess about market direction when I allow myself to, go down news rabbit holes, and generally hold a bunch of opinions which make things harder not easier.

System trading is an end run around all that bullshit. It doesn’t remove the impact of trading psychology, but drastically reduces it.

We all know that there is a thousand ways to fuck yourself while trading. And the only way I’ve ever found to un-fuck myself is to build a system.

If you are interested in adding some system to your discretionary trading, what I advise is to take your best “stuff” and build a system around it.

It’s a big job, but like we say here in Thailand…

“Baby, that dick just isn’t gonna suck itself!”

In the broad strokes my process is:

- Start with the goals. What do you want to make? how long do you want to spend at the screen each day/week? What drawdowns can you live with? Is it for income or compounding up for retirement?

- Find an edge (I find my edges in the price action, but there are lots of edges)

- Test that edge in isolation. This is key. When you test your trading system rules all together you are testing the complex interaction of entry setup, stop placement, when you move to breakeven or trail and take profits. In a statistical sense thats a hot mess, and you can never be sure you aren’t fooling yourself. You have to do *like a scientist* trying to disprove your theory, not like a creationist trying to prove it. Break things down into small chunks and test them individually.

- Once you are sure your edge is a real, honest-to-goodness edge you can start building a system around it. The next thing is to do a maximum favorable excursion analysis of where the winning trades get to. A little bit of logic and you can design a decent exit algo from that.

- Optimise NOT for maximum profit, but maximum risk adjusted return. No point in building a system you can’t live with.

- Test it small scale going forward and see if your backtests and forward tests match up.

Anyway, this is my detailed process. These are old videos, so excuse the quality.

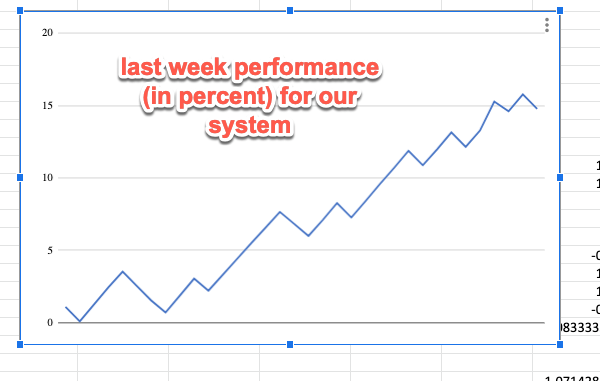

And here is the end result. This is my current system.

Results for the last week, and last year.

^^^^ This video is part of my paid course, but slopers can have it for free. It’s my full rules, holding nothing back.

Yeah, those results are real world results not some kind of hypothetical backtest nonsense.

Yes, the system is a real system not some kind of preferred technical analysis which I happen to like which still requires me being an expert. A monkey can execute my system and for a while I paid a guy to do it for me.

If you want to learn more about system design I have a mailing list I talk about it at http://www.scottphillipstrading.com