The other kind of inflation (Shvets Anna/Pexels).

Not Just Supply-Side Inflation

In a post in September (Supply-Side Inflation Hits Home), we wrote that the inflation we had been experiencing was supply-side inflation, rather than demand-side inflation:

we are experiencing supply side inflation (not enough stuff), not demand side inflation (too much money)

The idea we elaborated on there was that inflation was driven by supply shocks as a result of COVID lockdowns: less stuff was being produced during the lockdowns, so when the lockdowns ended, supply hadn’t yet caught up with demand.

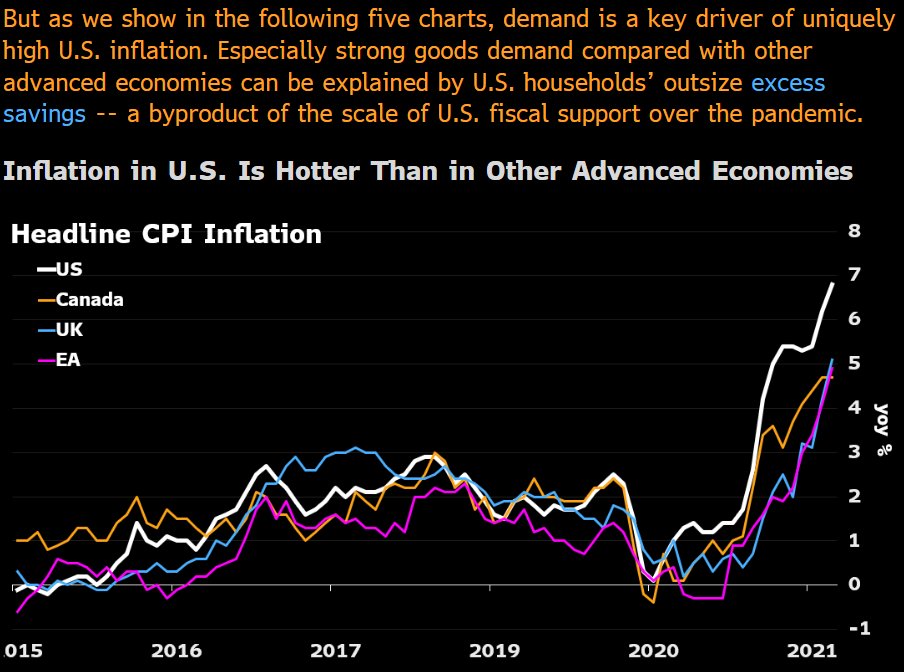

Supply shocks are responsible for much of the inflation in the U.S., Canada, and Western Europe in the wake of COVID, but not all of it. Bloomberg economist Anna Wong calculated that the reason inflation is running hotter in the U.S. is due to our government’s “fiscal support” of U.S. households during the pandemic. As you can see in the screen capture below (shared by TD Ameritrade lead anchor Oliver Renick) spiked across the West after COVID hit–but it spiked higher in the U.S. due to higher government spending here.

What To Do About This

The most obvious approach an investor could take here is buy things that should do well in an inflationary environment: precious metals, industrial commodities, and crypto. But recently, Bitcoin and natural gas (as tracked by United States Natural Gas (UNG)) have both stumbled, and the leading gold and silver ETFs, SPDR Gold Trust (GLD) and iShares Silver Trust (GLD) haven’t posted positive returns either.

Another Approach

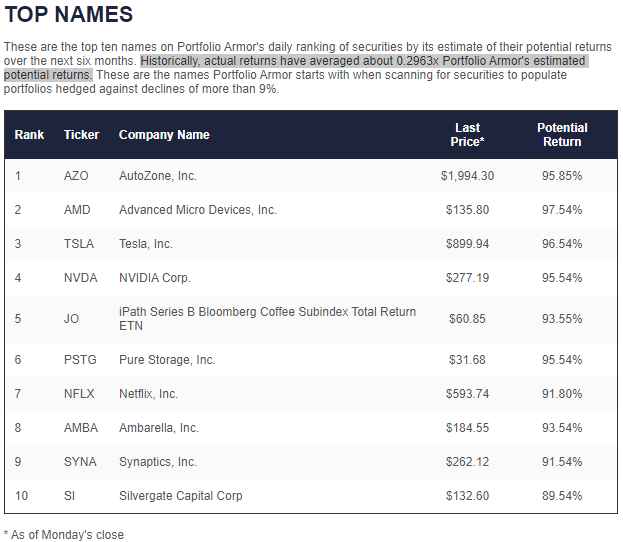

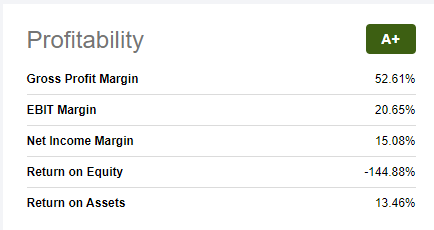

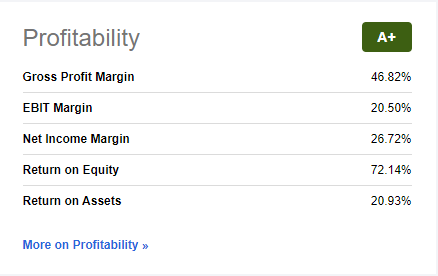

Another approach would be to look at companies with profit margins wide enough that they can be competitive in an inflationary environment without raising their prices too much. In an article earlier this week (Time To Buy Tesla), we shared our system’s top ten names from Monday. A number of these names have high profit margins. Let’s take a look.

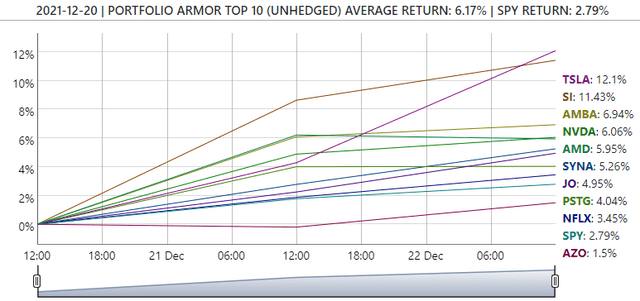

Screen capture via Portfolio Armor on 12/20/2021.

Although our system doesn’t analyze fundamentals directly, it turns out that six of the nine stocks in our top ten names from Monday have A-rated profitability metrics, per Seeking Alpha’s quant ratings (Monday’s top ten including nine stocks and one commodity ETN).

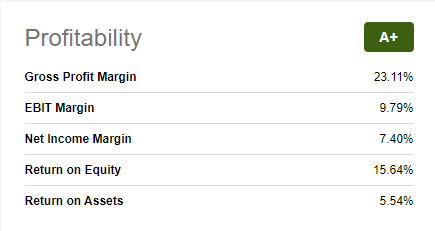

Autozone (AZO):

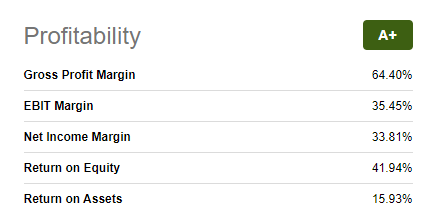

Advanced Micro Devices (AMD):

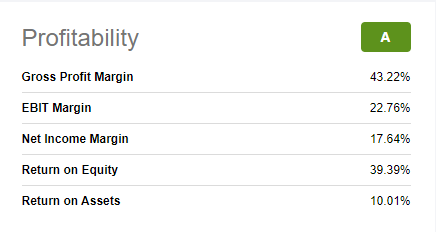

Tesla (TSLA)

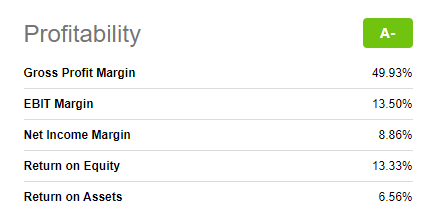

Nvidia (NVDA)

Netflix (NFLX)

Synaptics (SYNA)

Off To A Solid Start

Incidentally, our top ten names from Monday are off to a solid start so far, led by Tesla.

Safety First

As always, we suggest readers consider hedging if they decide to buy Fulgent or one of our other top names. Hedging will give you some protection in the event that we end up being wrong, or the market moves against us. You can use our website or our iPhone app to scan for optimal hedges on the names shown above.