The purpose of this post isn’t to say Brown Forman is a great short idea. Instead, it reflects the mood of the market and potential size of the bear. If this chart is bearish, I don’t want to short it, but I do want to find the consumer staples stocks that are in worse shape.

I saw this post on Twitter and ran the charts.

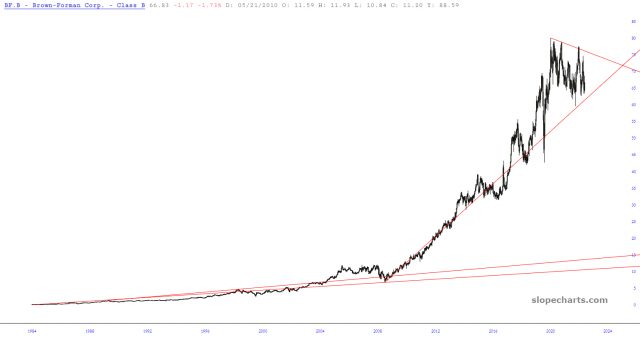

The bull scenario for this stock is a decline of 15 percent down to long-term support. That would be a great spot for buying in the midst of a bear market.

If that level failed, then it is probably a major bear market worse than 2000 or 2008. the 2020 low closer to $40 would open up as a possible support area.

The Charts

I’ve posted four charts below.

- Long-term log chart showing the permariser channel. Stay in the channel and you’re golden. Buy low and sell high.

- The run-up into the 2008 top, linear chart

- The run up into 2020 top, linear chart which looks very similar to the 2008 chart

- Charts 2 and 3 overlaid

Final point: if we rewind the chart back to 2008, there would have been a different support line, higher that current one. That older line was broken in 2008. If this is a larger-scale bear market, the support line can break again. Given the analog with 2008, we should be open to that possibility.