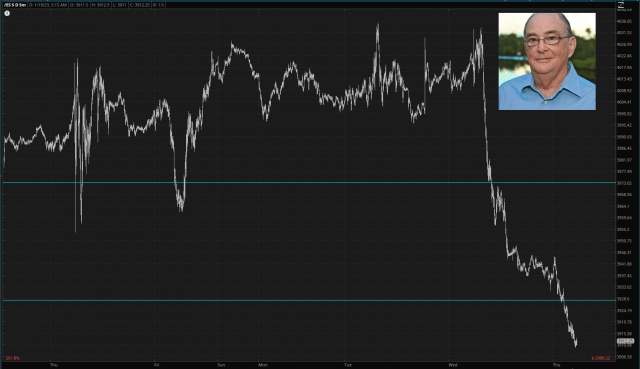

Let us think back to Slope’s darkest days. That would be, oh, about 48 hours ago. Those were grim times. The bulls seemed to own the market again. Bears had been beaten across the face fairly consistently since October 13, 2022, a day I shall remember until my last breath. Sentiment on Slope was turning fiercely anti-bearish and, God forbid, even anti-Tim. And, as always, people came out from the woodwork claiming that, being better than the rest of us, they were never bearish nor bullish, Nay, nay. They simply made money, no matter what. Every single time. Thus pitying us poor saps who actually had an opinion. And, as a topper, they trotted out some retired money manager in his 70s who had created some weird-ass arithmetic hack called the Whaley Breadth Thrust which was supposed to be God’s gift to investors and was correct 100% of the time, even though it sounded like it was taken straight from the Kama Sutra. Thus, they claimed, a New Bull Market was here, and bears were about to get destroyed, as they most deservedly should be.

Here’s one of the countless tweets vomited up that day proving beyond any shadow of a doubt that the minuscule bear market we had in 2022 was all it would take to cure the sins of the world, and it was now bull time again. This is very appealing, of course, because 99.99999% of humanity are permabulls, and they gobble this stuff up like super-sized fries at their local McDonalds.

If I had any sense left in me at all, I would have well recognized that this nauseating surfeit of disgusting bullish ranting meant one thing and one thing only.

This is not to say we’re out of the woods, even though the empty-headed, self-aggrandizing bulls have once again been humiliated. We have broken beneath one important breakout level. The next one down is going to be more of a challenge. And, of course, the ultimate challenge is going to be 3800 on the /ES, which is going to take global thermonuclear war to happen. Listen 99.999999% of humanity isn’t easy to beat. We’ve got to go big. So fire up those missiles, fellas. As long as Palo Alto is spared. Oh, and Durham.

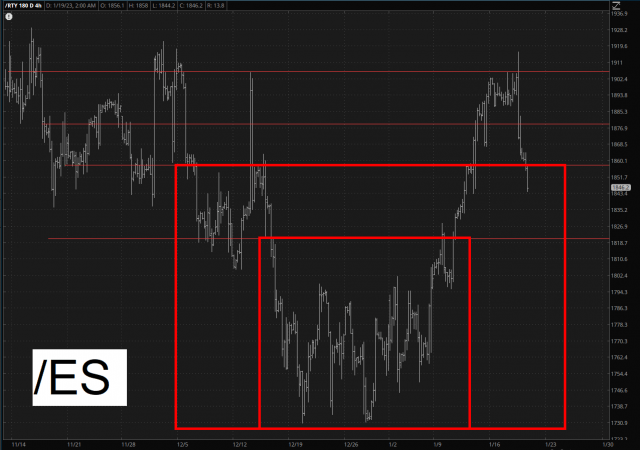

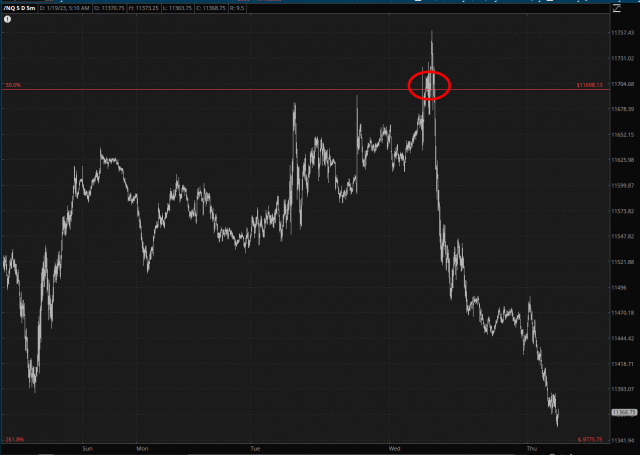

I am quite proud of my pointing out early yesterday the importance of the 50% retracement level on the /NQ. I wrote this in the very last throes of the revolting chorus of bullish yammerings.

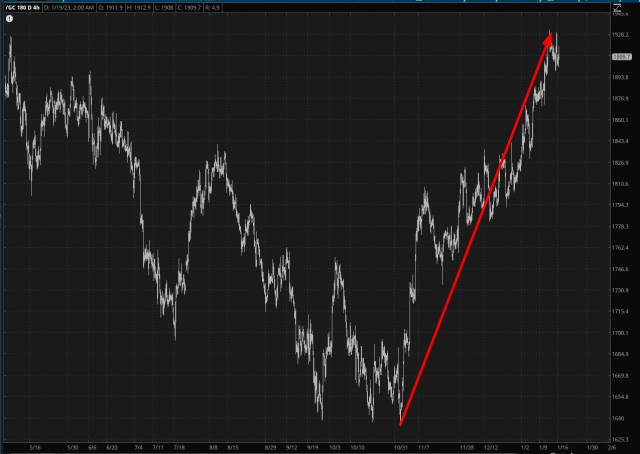

All assets, it seems, are joined at the hip. The crypto fraud, the precious metals kooks, and the equity hustlers are all part of the same breed. Keep a close eye on gold, which has been particularly frisky in recent months, for a sign that the downturn is going to have some teeth.

I went from 56.4% cash yesterday to 0%. Next week is when the earnings season goes to “11“, and here’s hoping that there are barge tankers filled with bad news heading our way.

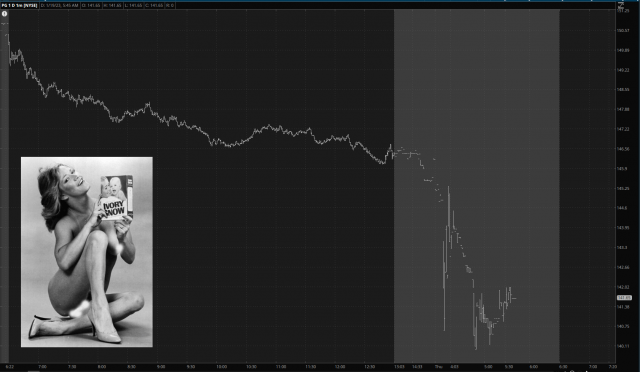

As for earnings, like I said, the super big week doesn’t start until Tuesday, but here’s Proctor & Gamble this morning, which is looking weak: