I have been absolutely thrilled at how the Slope community has embraced the TradeMachine Pro technology created by my friend Ophir (he’s done webinars here on Slope before, and if you’re an options trader, you should click the link and check it out). His latest idea is about a company called CloudFlare (symbol NET) which, coincidentally, Slope also uses to support its web infrastructure.

What I’m working toward – — – with the help of my oh-so-awesome Virtual Trading Testers – – is the day when we can look at ideas from TradeMachine (or anywhere, for that matter) and execute those trades virtually here on Slope in order to test them out and get our confidence up without risking a single penny (as I call it, “trade without the trauma”).

I’ll let Ophir take it from here…………….

A Trigger to Get Long: Three Inside Up, RSI, Moving Average Trigger in Cloudflare Inc

Disclaimer

The results here are provided for general informational purposes from the CMLviz Trade Machine Stock Option Backtester as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

Preface: Precision Technical Analysis, Not Just Drawing “Lines on a Chart”

Either there is a technical reversal trigger that signalled an impending intermediate-term rally (a bullish move) in a stock or there is not.

Rather than “draw lines on that chart that time,” we tested it empirically across a decade and half of data and tens of thousands of backtests.

In this case we specially look for the technical conditions that demonstrate three requirements. This doesn’t mean it’s a trigger now, it means creating an alert for the coincidence of technicals would help. We wait until these three things happen at the same time:

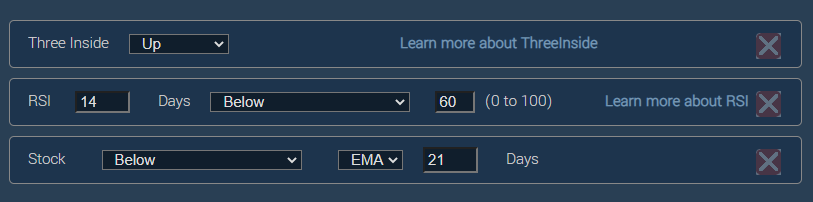

Here is the set-up in Stock TradeMachine®.

And in words:

1. A stock has experienced a three inside and up move.

2. The stock price has a 14-day RSI below 60, to assure it is not in an overbought condition.

3. The stock price is below the 21-day exponential moving average (EMA), again forcing the upside to have room.

This strategy looks to win if the stock rallies in the short- to intermediate-term, and in this case, specifically a 22-trading day window (2trading days is about one calendar month) after the trigger.

After rigorous testing over multiple time periods including, but not limited to, the 13-year period from January 2007 through March 2020, and the Great Recession (September 2007 through March 2009) and over 100,000 back-tests, today we demonstrate the technical conditions that have provided a strong intermediate-term bullish trigger for Cloudflare Inc (NASDAQ:NET) .

If you ‘re not making use of computing power to examine patterns, then the algorithms are using you to profit. That’s it.

CML Efficiency Score™

At Capital Market Laboratories (CMLviz), we have created a standardized reward to risk measurement for backtests called the CML Efficiency Score™ (ES).

The ES takes the average trade return from each triggered backtest (the ‘reward’) and divides it by the maximum drawdown (the risk).

The max drawdown is measured as the largest open-to-trough decline in the value of a backtest for each new opening trade.

Our view is that an CML Efficiency Score above 0.8 is very good. An CML Efficiency Score above 1.0 is excellent, demonstrating that the average return is in fact larger than the maximum realized loss.

3-Year Backtest Results: Three Inside Up with RSI in Cloudflare Inc

Here are the results for a long stock position held for 22 trading days tested over the last 3-years in Cloudflare Inc once the technical requirements have been met:

| NET: Long Stock for One-Month | ||

| % Wins: | 100% | |

| Wins: 2 | Losses: 0 | |

| CML Efficiency Score™: | 11.03 | |

| Return: | 7.9% |

Click Here to See the Back-test

The mechanics of the Stock TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

We see 2 wins and 0 losses with a total backtest return of 7.9%.

We note an CML Efficiency Score™ above 1.00, which is excellent.

One-Year Backtest Results: Three Inside Up with RSI in Cloudflare Inc

Here are the results of the same trigger, but hyper focusing one just the last year — and we see that all trigers within the last three years are in fact from the last year.

| NET: Long Stock for One-Month | ||

| % Wins: | 100% | |

| Wins: 2 | Losses: 0 | |

| CML Efficiency Score™: | 11.03 |

We note an CML Efficiency Score™ above 1.00, which is excellent. Once again, here’s that link for more information about TradeMachine.