Well, I might as well succumb to World Cup Fever, which has affected even Slopers. Hence, the subject line for this post. Anyway, I just wanted to share a few thoughts on a handful of charts before calling it a day.

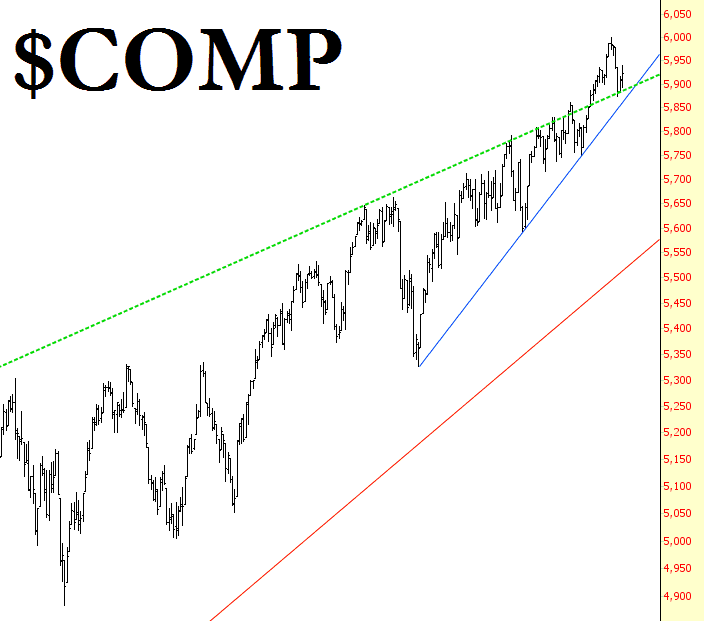

First, the Dow Jones Composite pretty much tells the story – – – last week’s dip was simply “the pause that refreshes”, and since it failed to break the supporting trendline (the dotted green one), we are still in the same Bull Mode that we’ve been in since John Kennedy was in office and color televisions in every home was just a distant dream.

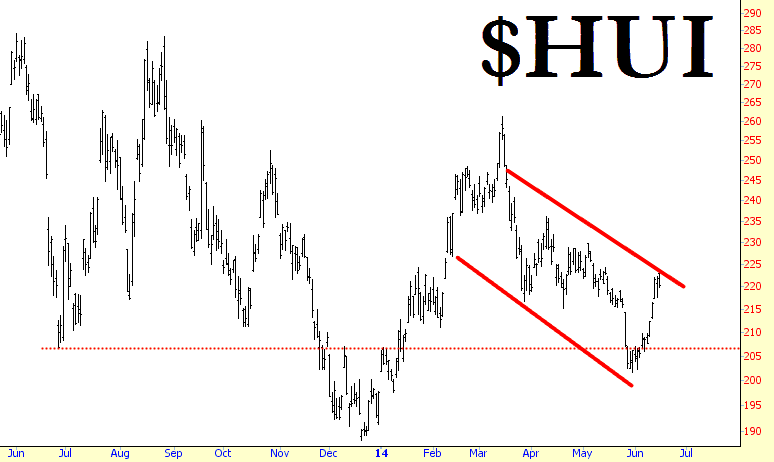

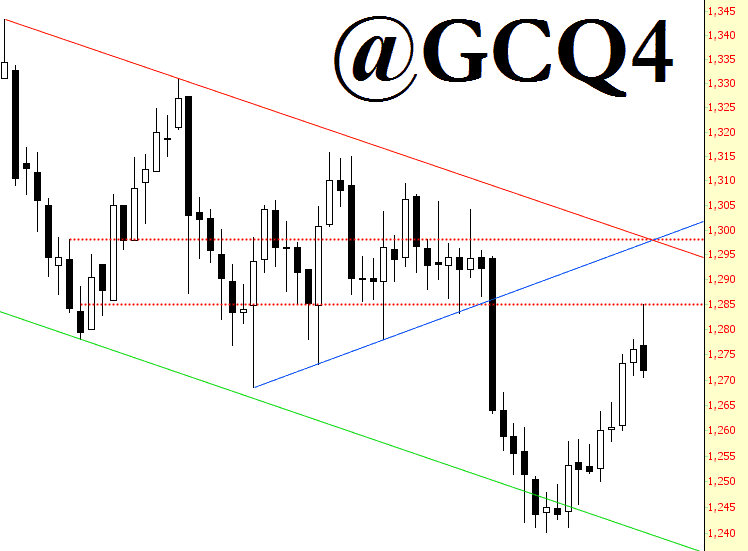

In spite of this, I turned a profit today with my all-short portfolio (albeit a modest one, obviously). I only have one big position, and that’s my gold short. This is brand new (I have, until today, been loudly bullish about precious metals and their miners). My view is that we’re going to retrace most of those gains in the coming days.

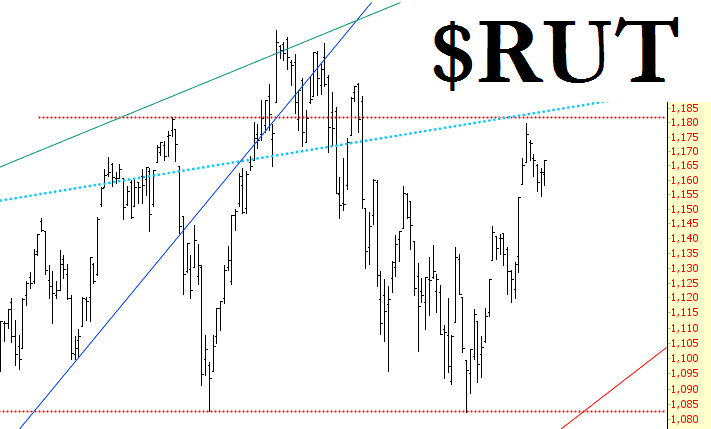

The Russell 2000 still is providing the potential – the possibility – of forming a big topping pattern. We really need to stay beneath that dotted red line to make it happen. I suspect by Wednesday’s end, we’ll have our answer, once Yellen finishes her big announcement and press conference.

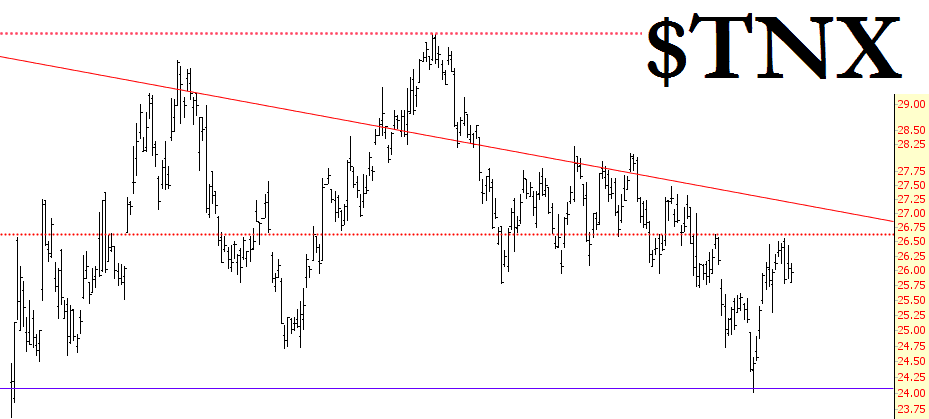

Lastly, interest rates still look poised to head lower. The lower line in the “mark of Zorro” below is resistance, and provided we stay beneath it, strong bonds and utility stocks are probably on the horizon.

Monday was dead quiet, and Tuesday may well be the same. It’s pretty evident that even thousands of killings in the Middle East aren’t going to budge stocks downward. We are, once again, just waiting for the Fed.