The big news today is the FOMC dove convention from which few are expecting any interesting news. No doubt we’ll get the usual blather about how the huge step of raising interest rates from almost nothing, to slightly more than almost nothing, will only be done after all the current Fed members have been carried out of Fed HQ in caskets. That may or may not be bullish but it’s hard to see a big move from FOMC today.

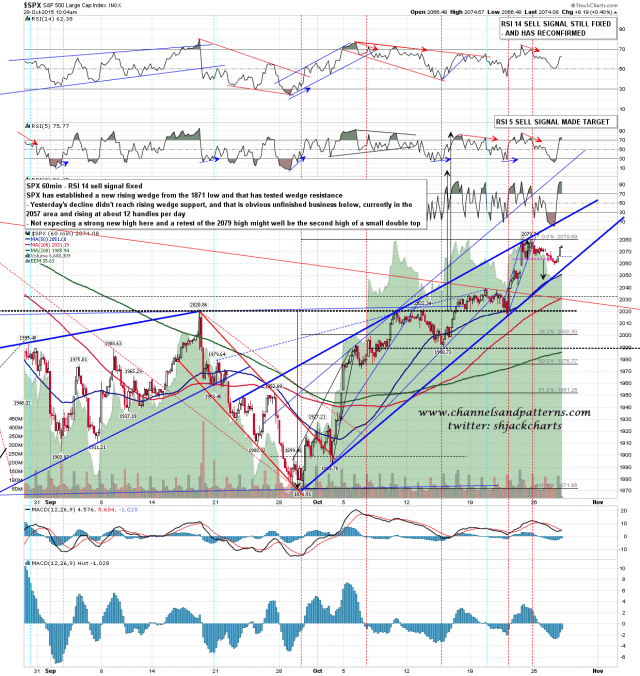

The decline on SPX didn’t quite hit wedge support yesterday and that is unfinished business below. That is currently in the 2057 area and rising at about 12 handles per day. There is still a possibility that this is a rising channel and, if we were to see a break over wedge resistance before a test of wedge support, that would increase the odds of this evolving into a rising channel considerably. SPX 60min:

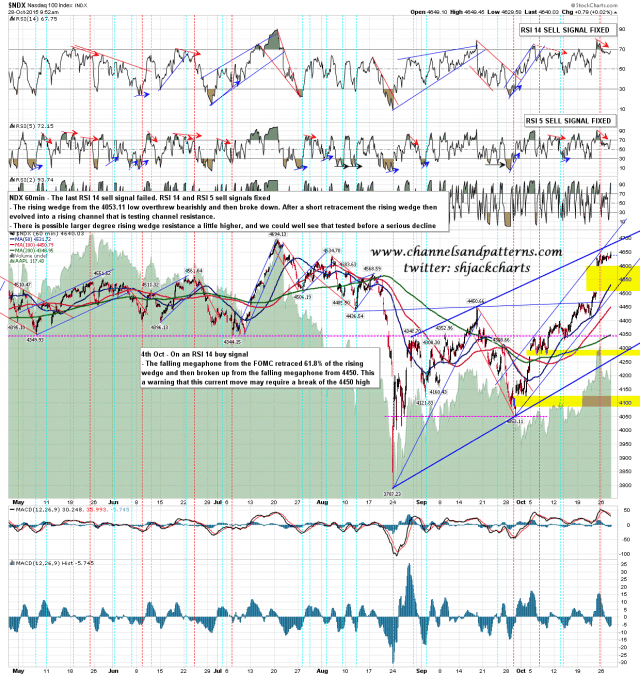

I have a slightly higher target in the 4670-80 area on NDX that we may well see hit before a more meaningful decline. NQ looks cooked and ready to go though so that’s a maybe. NDX 60min:

Both SPX and NDX have open 60min sell signals and could start a larger decline at any time. There may well not be much to see either way before FOMC at 2pm, and there is an obvious high retest target on SPX at 2079 that we could hit before FOMC.