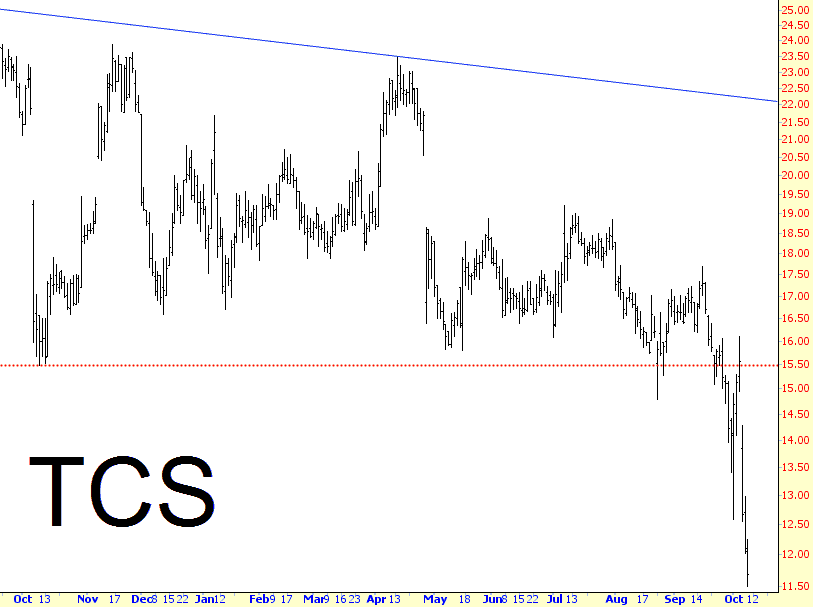

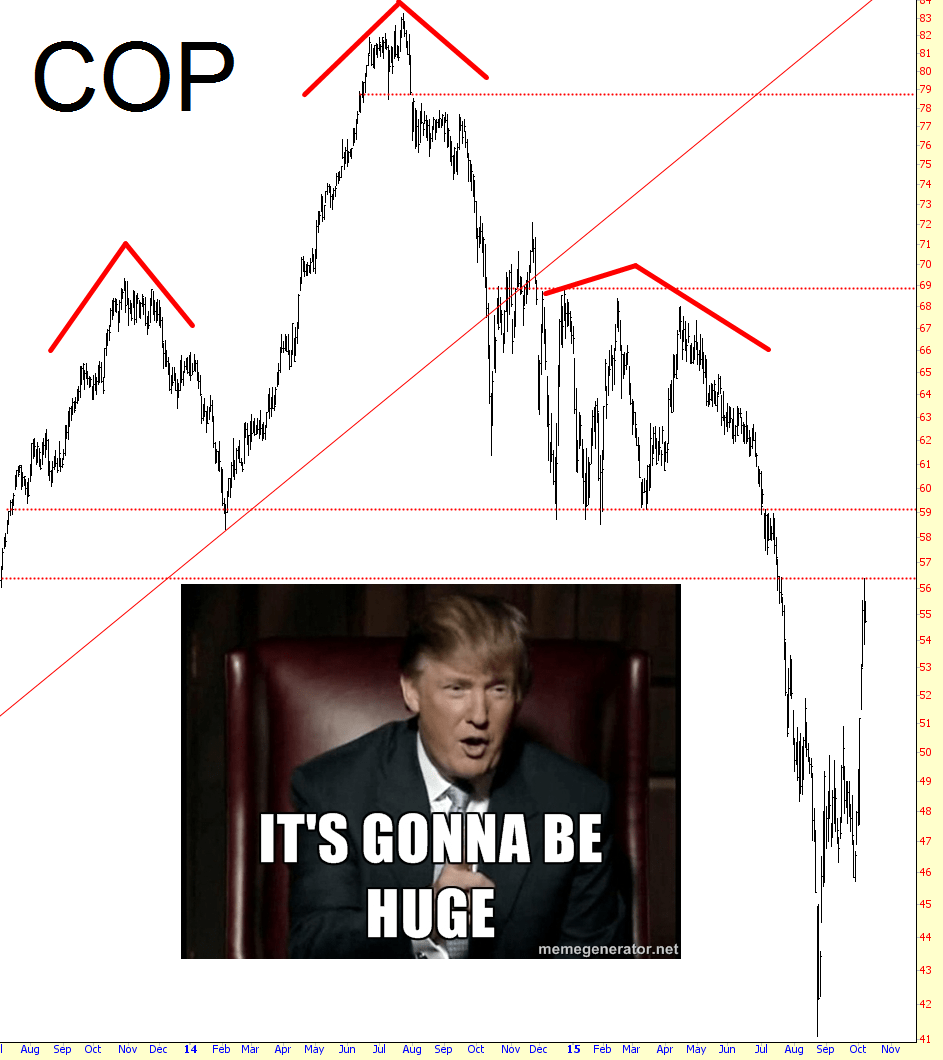

October continues to utterly stink for me because of the one-two punch of (a) strong equities and (b) strong commodities. I’m far from giving up hope, however, because the individual equity charts look as good as they ever did, and as prices have ascended, the quantity of sensible opportunities has expanded, since the risk/reward ratio is becoming more appealing across the board.

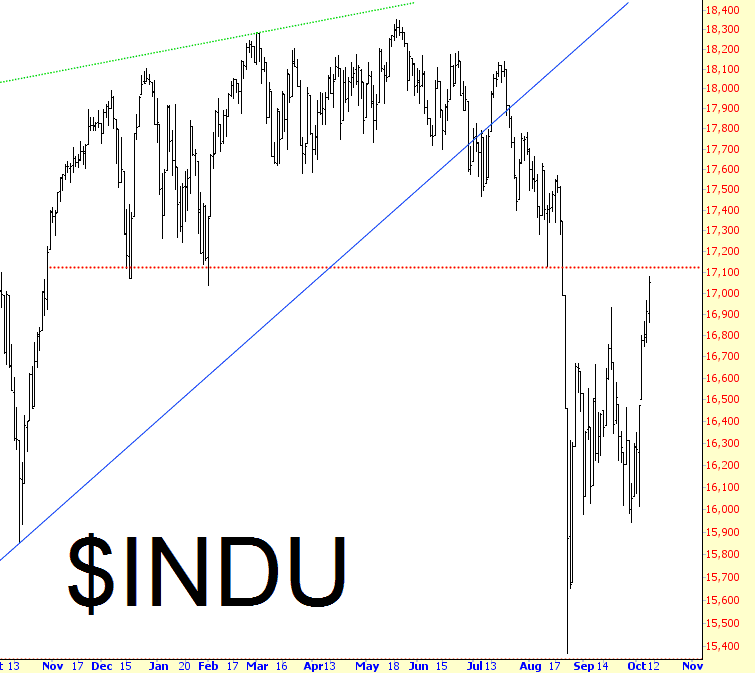

The “easy” part of the bull run is just about done, I think, as most indexes approach the huge overhang of supply. A couple of weeks ago, stocks were so battered that adding to shorts didn’t make sense. At present price levels, I think we’re getting a second bite at the apple. The Dow Industrials has a huge top between 17,100 and 18,400, and the 1700 point rise in the Dow (!!!) since the August crash puts us just beneath that big top.