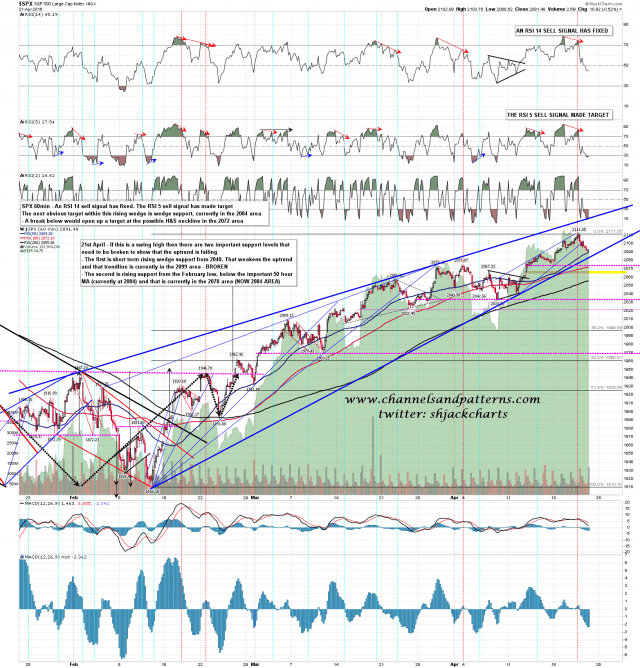

The 60min RSI 14 and RSI 5 sell signals on SPX that fixed in the last hour on Wednesday were playing out yesterday. The RSI 5 signal has made target, but the RSI 14 sell signal is still some way short of target. The low yesterday was at a test of the important 50 hour MA on SPX and it could find support there. The falling wedge that I posted on twitter yesterday afternoon is suggesting a possible strong bounce or retest of Wednesday’s high, and if bears want to avoid that then they have important targets below to be tested and broken this morning.

On SPX the key target is rising wedge support from the February low, currently in the 2084 area. A break below would open up the possible H&S neckline in the 2072 area. SPX 60min chart:

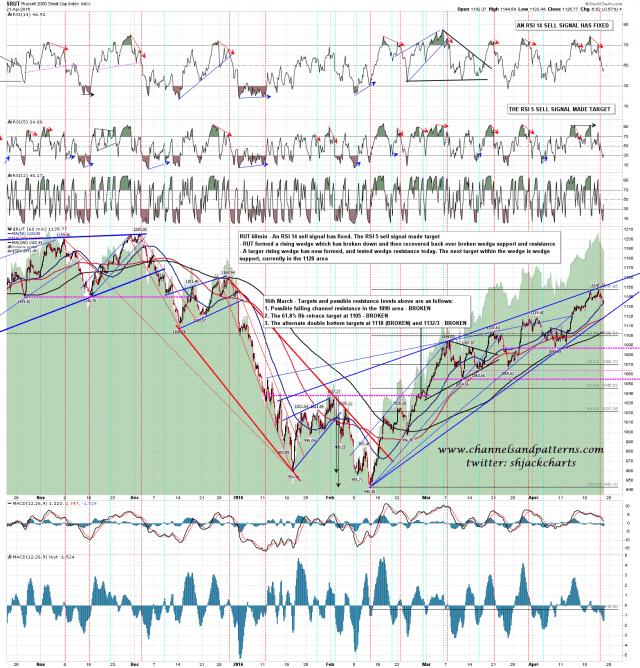

On RUT the key target is rising wedge support in the 1120 area. I’m seeing RUT as the lead index here so I’ll be watching that carefully. RUT 60min chart:

The broken falling wedge from the high on SPX looks bullish, but the other patterns I’m watching here are the H&S on NQ that broken down on the GOOG earnings last night and has a target in the 4435 area (not shown) and the TF double top that is breaking down with a target in the 1120 area. With the open 60min sell signals the bears have the technical edge this morning in my view, even without the bigger picture daily sell signals. TF Jun 60min chart:

I’d like to see an AM high that fails today into breaks of those support trendlines. If a rally gets going this morning then that could extend into a marginal new high on SPX but would be unlikely to get much higher.

If you missed the educational webinar that Stan and I did yesterday after the close on using TA in trading then the recording for that is posted here. Everyone have a great weekend 🙂