Before I take off for the balance of the day (there are other posts already in the queue), I’ll just share a few ETF charts and some words on each:

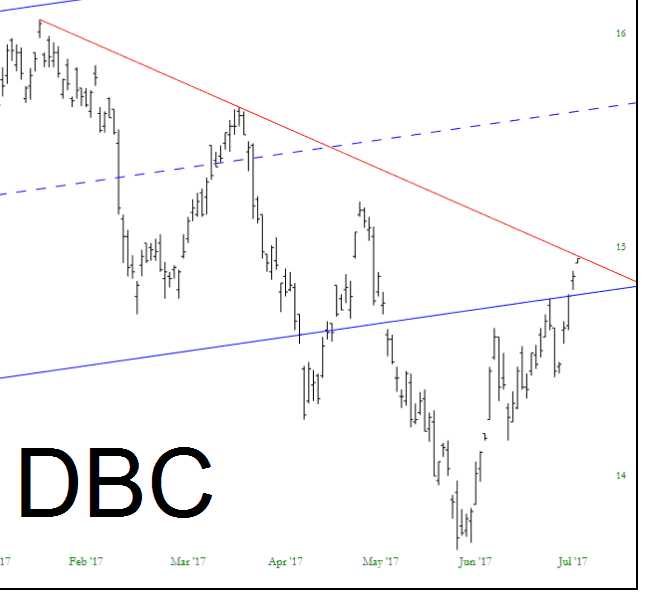

First of all, I’ve pretty fairly well prison-raped lately by commodities (oil, gold) recently, so I’m tending to stay away from the likes of DRIP, ERY, JDST, and the like (even mild stuff like GLD). The moment of truth is at hand for commodities (DBC), but, again I’ve had enough for now. No thank you.

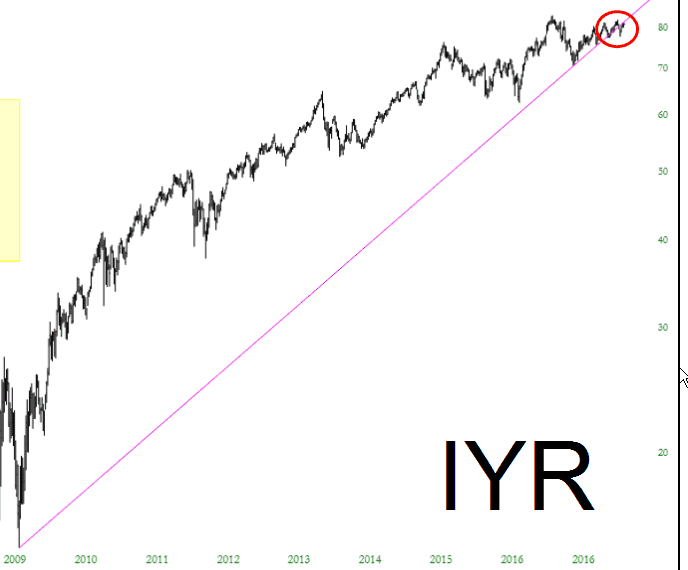

I feel better about being short real estate by way of the IYR short, which has busted its long-term trendline.

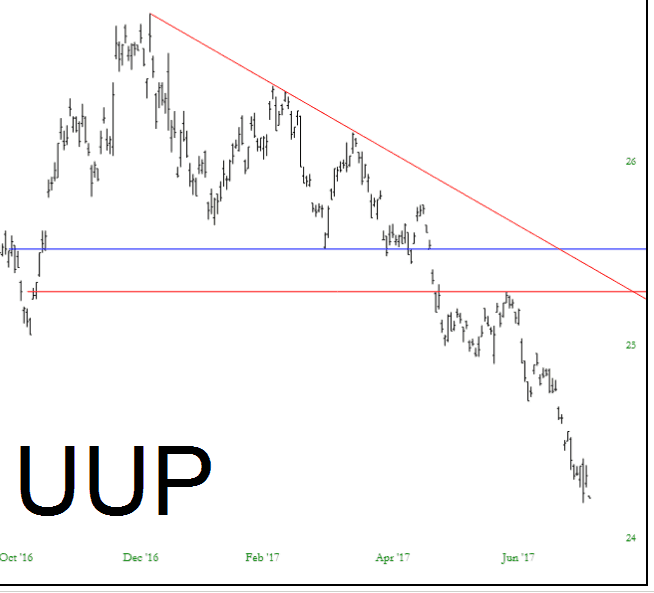

A big reason for gold’s continued strength has been the US dollar keeps plunging. This is very much a “it’s got to go up SOME time!” chart, but, here again, forget it. I’m tired of thinking the bottom is in for the dollar. The way Trump/Congress keeps screwing up, I’m not surprised the dollar (and the reputation of our country) is so weak.

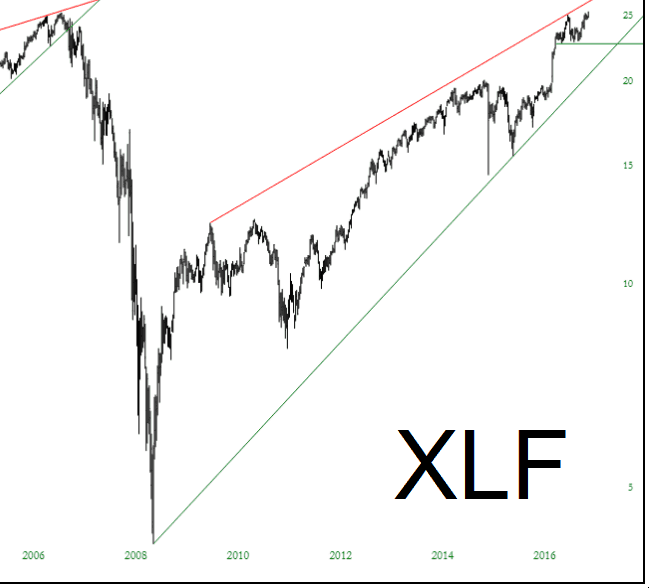

I am short financials by way of XLF (and, incidentally, am long bonds through TLT). The analog seems plain to me:

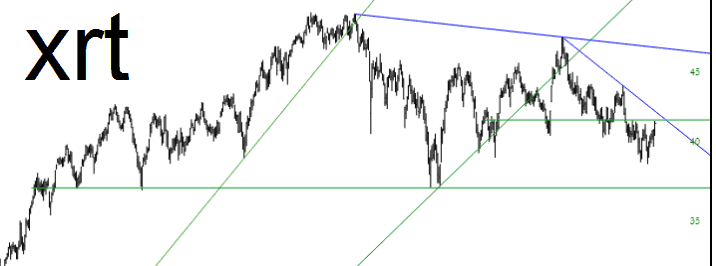

Retail’s strength burned me recently, but I’ve shorted XRT and a handful of other stores; I think the likes of Amazon are ultimately going to torch brick ‘n’ mortar.

Well, that’s enough. Most bloggers on vacation hang up a “Gone Fishin'” sign and just close up shop. Not me. I feel the weight of responsibility to my followers. It’s one of my many flaws.