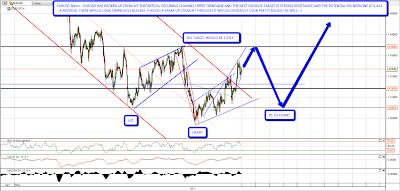

Looking at the charts this morning they're looking fairly bullish to me. On ES a test of declining resistance from the high seems likely today.A break of declining resistance would be extremely bullish with the big falling wedge indicating back to the high. A small IHS and smaller falling wedge are targeting the 1340s and strong resistance, along with a larger potential IHS neckline, is at 1345:

Declining resistance on NQ is already being tested, with another small IHS targeting 2366. Strong resistance, and a potential larger IHS neckline is in the 2370 area.

Declining resistance was broken overnight on TF, though the trendline wasn't as strong as the ES equivalent. Another little IHS is targeting the 844 area, though there's a resistance area on the way at 839:

EURUSD broke up through the potential channel resistance trendline I posted yesterday morning and the obvious target is now 1.434 for another potential IHS neckline.

Copper has broken the resistance levels at 412 and 416 I posted the other day. there's some possible resistance at 419, but otherwise I'm seeing the next likely target at 426.8:

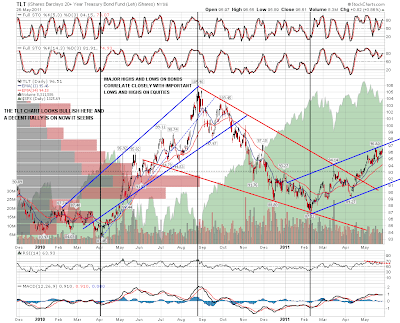

Bonds tend to move inversely to equities, so I thought I'd have a look at the TLT chart this morning. Sure enough, TLT is making a double top with negative RSI divergence at rising channel resistance. A fall to the 91-2 area looks likely next, which would be bullish for equities. It's worth noting on this chart that the last channel high on this TLT chart was just before the March low on equities:

Not much for the bears here so far but I do have one ray of hope for the bears to show this morning and that's a possible H&S pattern forming on SPX that vandalay pointed out to me the other day. I'm not sure what I'd give for its chances here but the neckline trendline is undoubtedly perfect:

I'm leaning bullish here but we could see some retracement today. If so, I have short term rising support on ES at 1318.5. Today will be a low volume pre-holiday day, which probably favors the bulls. Tuesday will be the last trading day of the month, which is distinctly bearish statistically. It might be that a bullish breakout might wait until Wednesday.