Well, it’s Sunday morning, and time to chime in on the VIX-heading-to-single-digits market of ours. I’ll just share a few words about each of the charts below.

First, the Dow Jones Composite: steady as she goes, I suppose. It has cleared its trendlines, and although it might, on occasion, ease back to that blue supporting trendline, there is nothing particularly vulnerable about this chart.

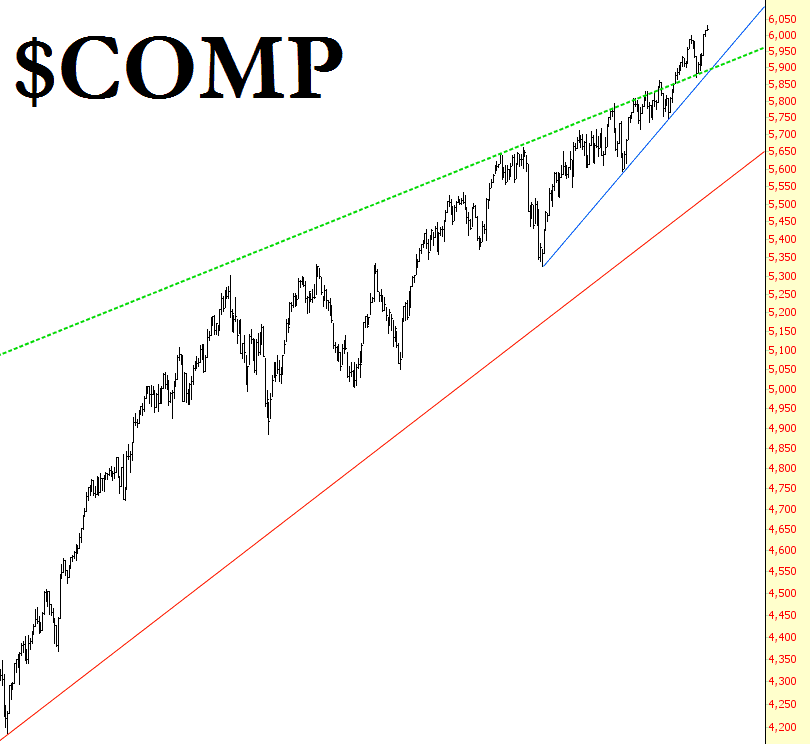

The NASDAQ Composite is a hair’s breadth away from its own breakout. If it instantly slumps on Monday, sure, we might have a double top, but it seems more likely that it’ll just lilt right over that horizontal line and continue breaking out higher.

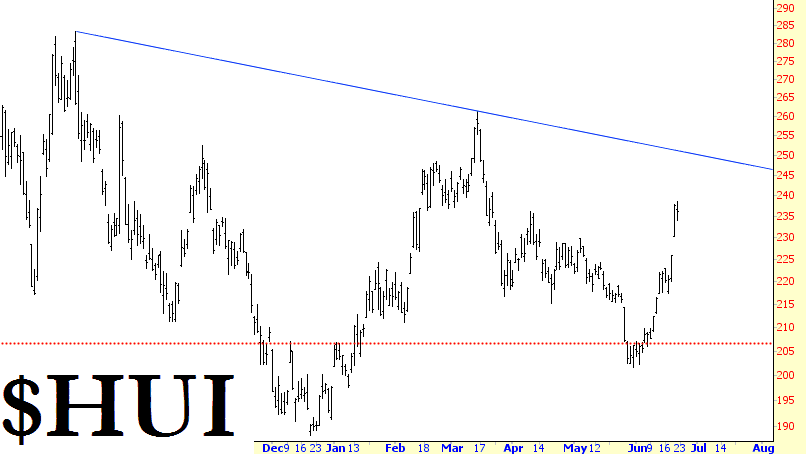

The gold bugs had a great week, of course, and I still think there’s room to roam higher, although I’m watching that descending blue trendline as the next pause point.

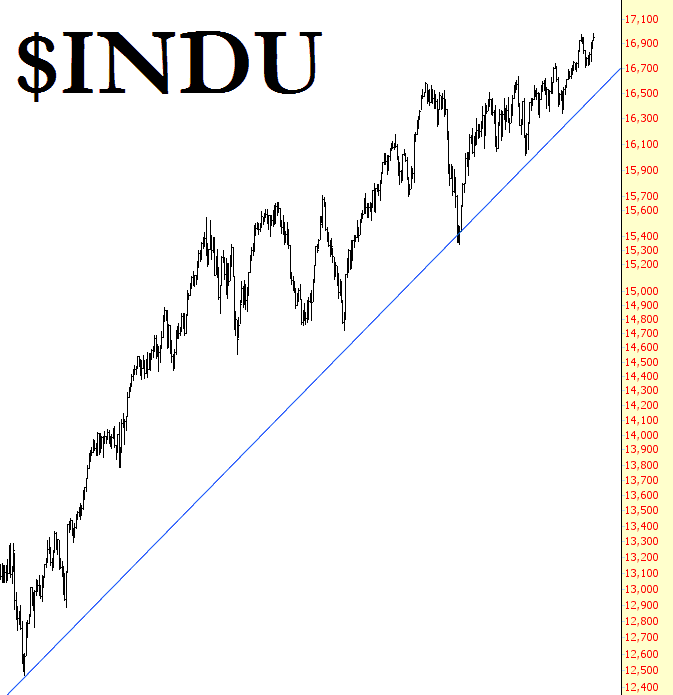

The Dow 30, like the Dow Composite, is in a positioned to move higher, and any weakness should be stopped by the blue trendline. Psychologically, there’s a lot of motivation in the market to reach the never-before-seen 17,000 mark, which is virtually a foregone conclusion at this point.

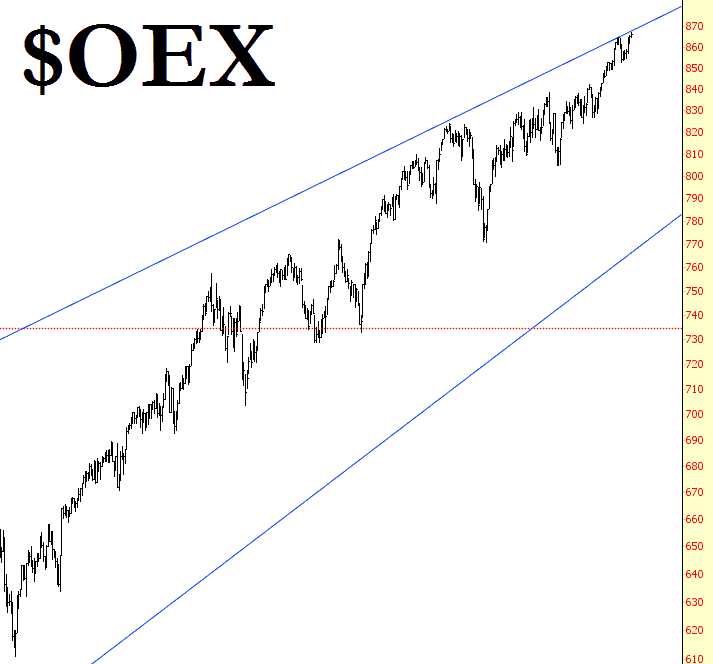

The OEX does a good job illustrating that, as well-position as the market is to move higher, it is definitely lofty, and I’d have difficulty making an argument for any significant strength in the weeks ahead. In other words, there is an opportunity for some very modest, nominal, “new highs again!” type gains, but with the market already at new highs, it would only have to eek out a tiny gain on a regular basis to accomplish this. We are not poised for any big move up anymore.

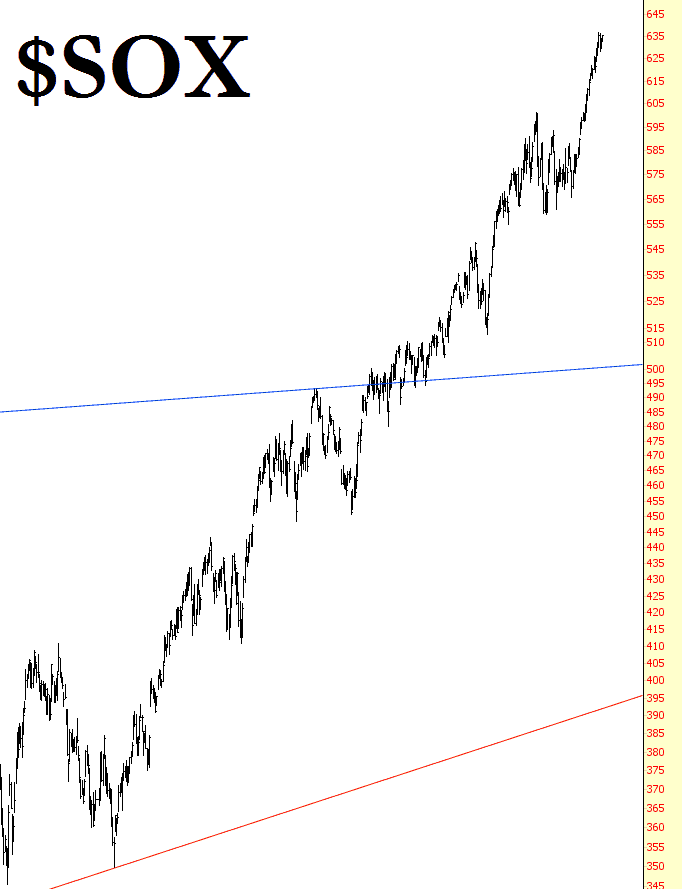

This point is amplified, I think, by the hockey stick chart known as the semiconductor index:

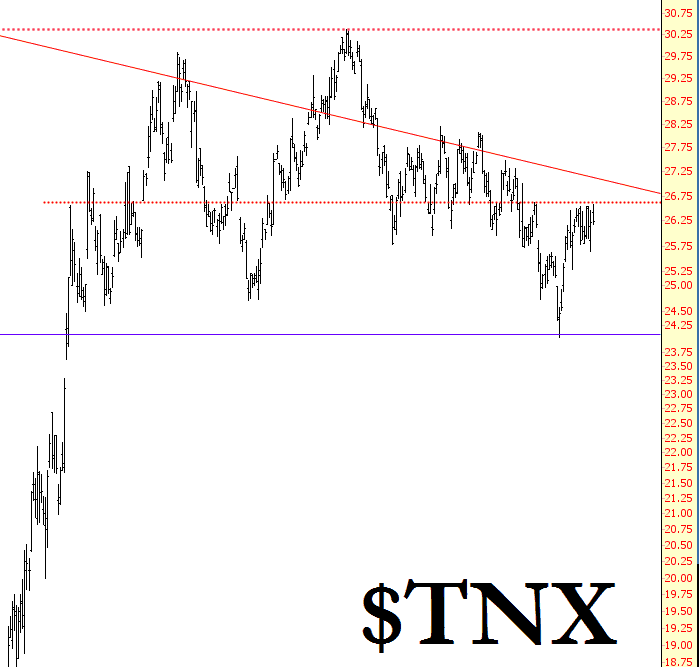

Lastly, interest rates are still unresolved. They are precisely at the decision point level which will either (a) push them above that trendline, wrecking the topping pattern, or (b) let them complete the topping pattern and, potentially, even break the blue line, which would send interest rates plunging and bond prices surging higher.

That’s it for me; have a great rest of the weekend.