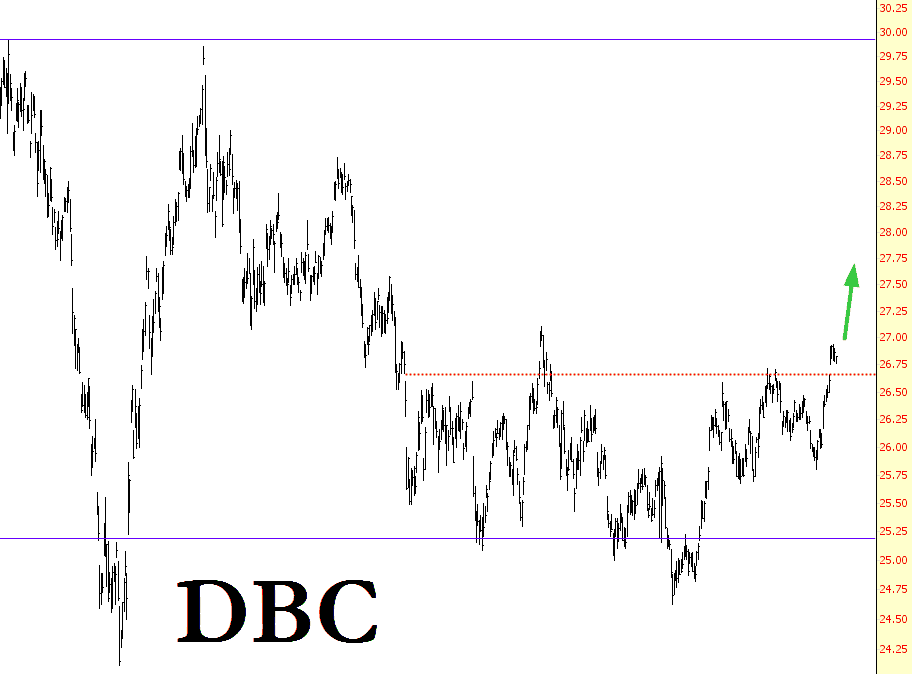

My “balanced” Slope of Hope continues with another bullish idea – commodities. That is, symbol DBC, shown below, which I am long. In spite of what your government is telling you, inflation is heating up, and as the central banks of the world force their servants/masters (the big banks themselves) into spewing ever-more cash into the economy, you’re going to see this launch like a rocket.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

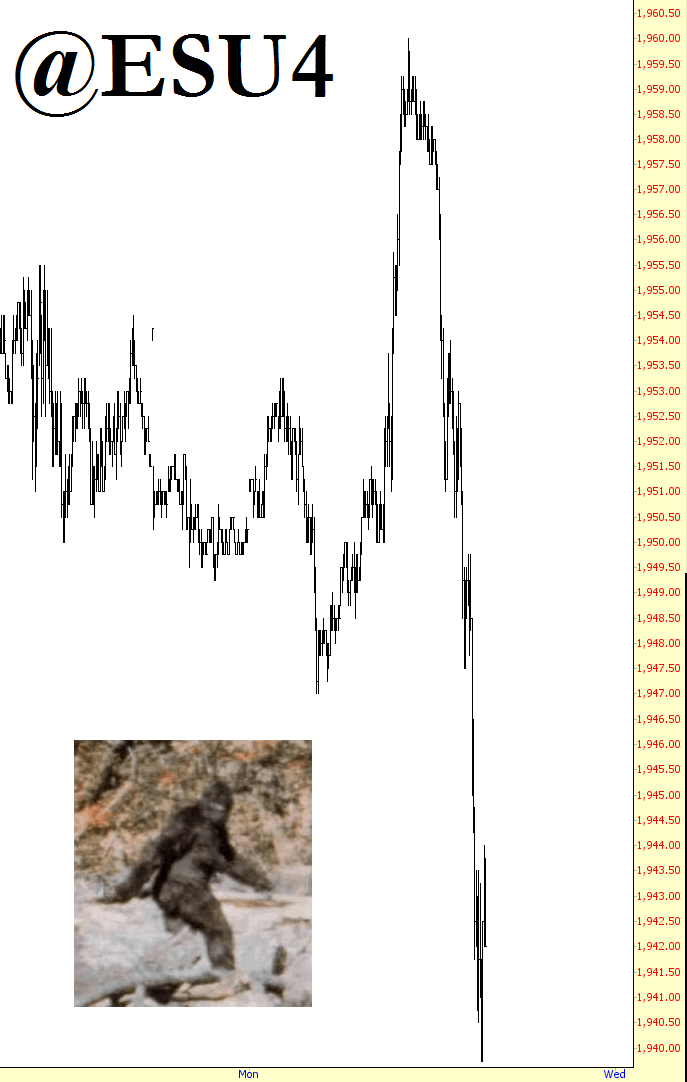

A Road to 1884

SPX made my target area at 1965-70 and rejected hard there. A candidate significant high for a 10%+ correction is in place but we’re going to need to see some follow through here first to open up the obvious downside targets for that correction. On the SPX 60min chart the 50 hour MA was broken near the close yesterday and SPX closed below it. I’d like to see that established as resistance today and after that any significant break back above it would be a warning that this retracement might be over. (more…)

Precious Metals – Definitely Maybe

Back on 22nd January I posted a chart showing that the falling channel on GDX from 54.18 had broken up and wondered aloud whether the precious metals bear market was bottoming out. That low was supported by very powerful positive divergence on the weekly RSI that I would normally associate with a major low. That low has held since and GDX has put in a higher high and (most likely) low since then, although that would also generally be the case on a bear flag of course, and that is always a possibility for a shallowly rising channel coming off a steep decline. If GDX can break over falling channel resistance from the high, currently in the 34 area, that should confirm a major low. GDX weekly chart: (more…)

My Town’s Transformation

I’ve lived in Palo Alto since the summer of 1984 (it only just occurred to me typing these words that this is my 30th anniversary here – maybe I should get a cake or something). Think about how much the world has changed since then; in 1984: (more…)