Well, all the jokes about my absence from the United States causing the market to fall, and how my return would cause it to rise, seemed to be eerily prescient. The market bottomed literally the moment I left Berlin, and by the time I touched down in San Francisco, the ES was over 30 points higher. Incredible.

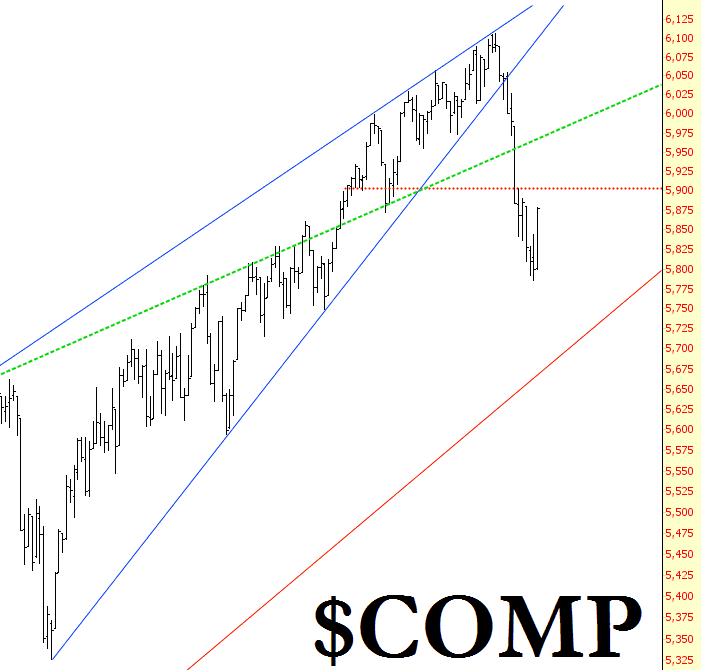

I’m the impatient sort who would prefer to see the market fall every day that ends with the letter “Y”, but these BTFD rallies are just part of the game. The important thing, in my opinion, is that so many crucial trendlines have been broken, we are truly in a different market now. These rip-roaring rallies are simply blowing off some excess fear, but the general direction really is “down.”

The Dow Jones Composite reversed about a week’s worth of down days in the course of a few hours. The most obvious resistance level is that red horizontal, although with enough “good” news (e.g. Putin declaring he would not launch nuclear war for at least a full week), it might get back up to that green trendline.

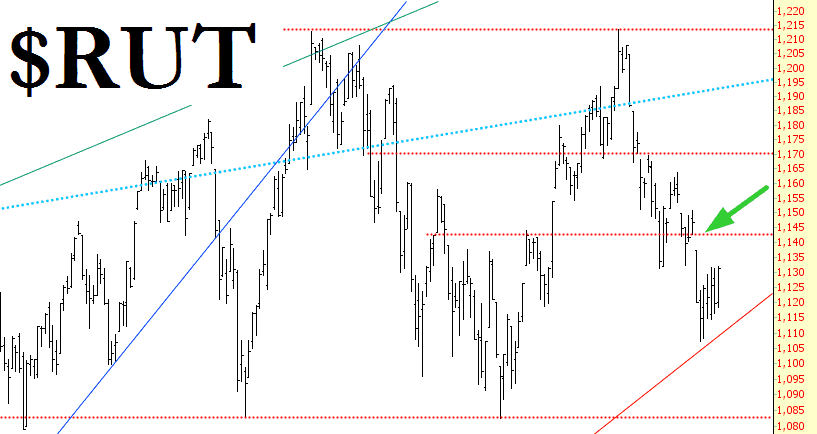

The “obvious” goal for the Russell is to fill the gap which I’ve marked with an arrow.

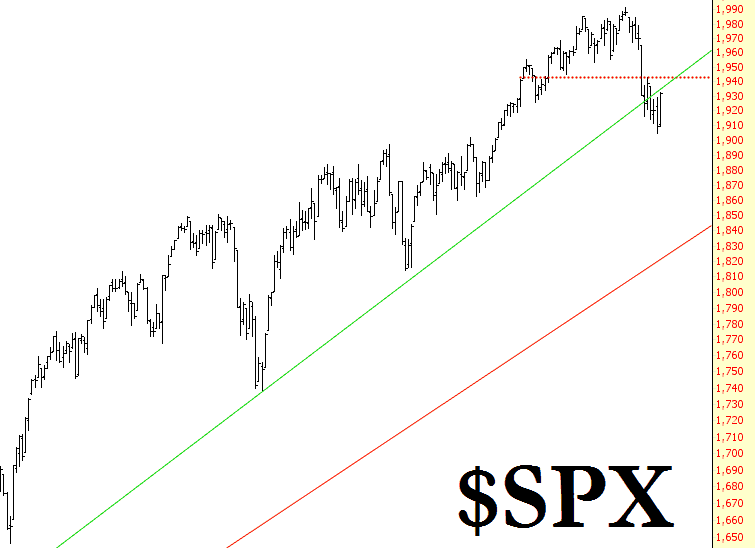

The S&P 500 is right in the midst of two intersecting points of resistane: that red horizontal as well as, far more importantly, that broken green intermediate-term trendline. Strong support, from my point of view, won’t be had until we make it down to the red long-term trendline, which is about points away.

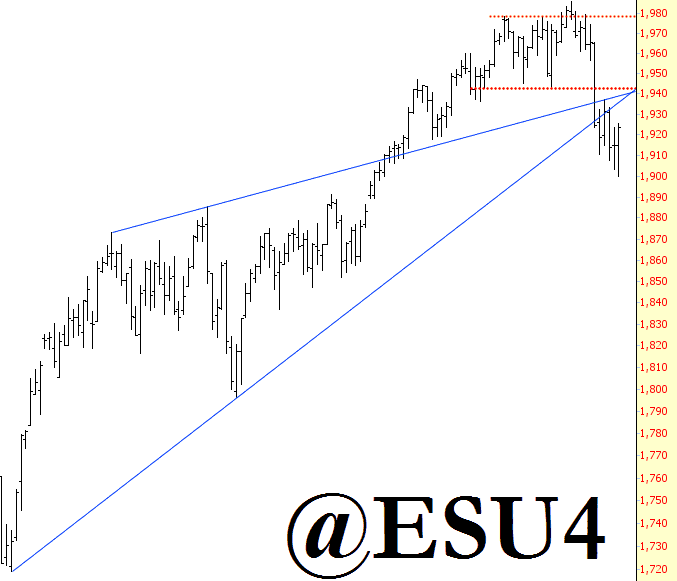

Lastly, looking at the ES, you can see the range we were trapped within for so many weeks, spanning about 1945 to 1980; that was broken with gusto, as was the wedge defined by that two trendlines below. I think August and September (somewhere in the midst of those two months) is going to represent the best bear opportunity for quite some time.