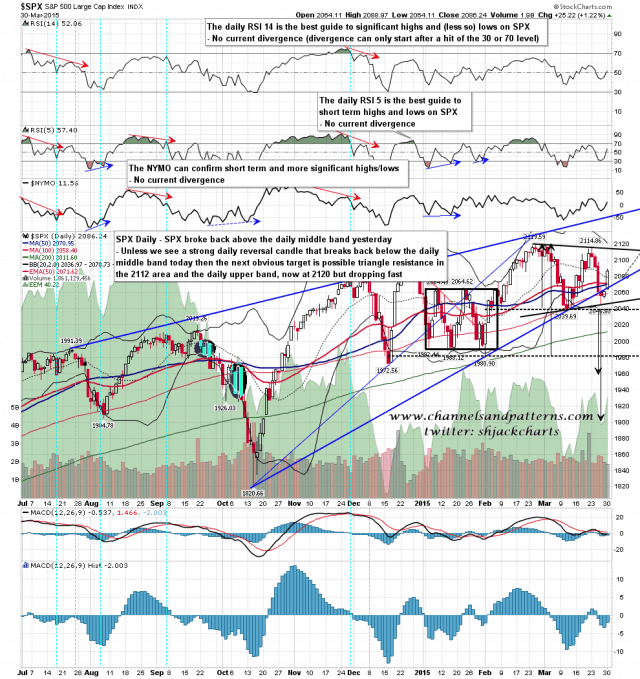

SPX broke back above the daily middle band at 2078 and unless we see a strong reversal candle today that negates that break up, the obvious next target is over 2100. ES has been very weak overnight and we could see that strong daily reversal candle today, so I have the odds of more upside here in the 75% area with 25% odds on a break back down. If we see a break back down that breaks the 2039.69 low, then we may well see a move to the double top target in the 1960 area. SPX daily chart:

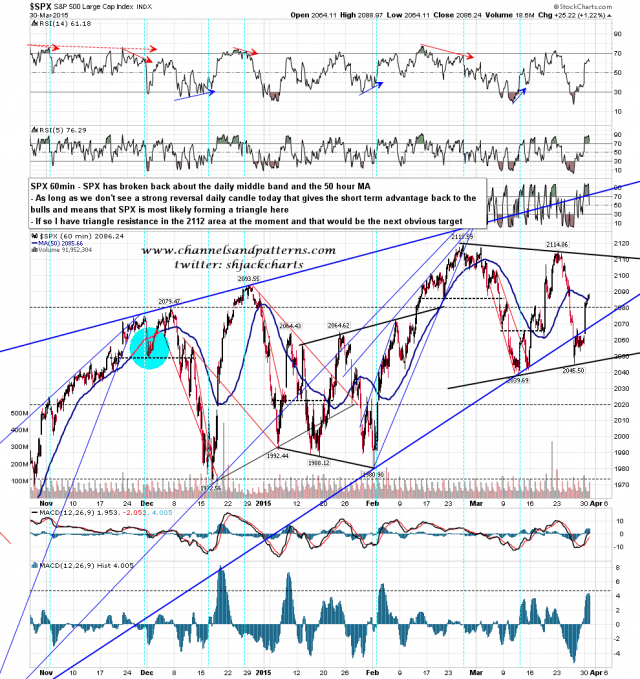

The upside scenario is something I was discussing on twitter yesterday, and that is that SPX is forming a large triangle. Triangle resistance is currently in the 2112 area and I’d expect that to be hit soon. We’d likely see a retracement there and then a break up, as in this context that should be an EW continuation triangle for the move into the main spring high. I’ll be talking more about the targets for that tomorrow but it would be a very nice setup for the next few months. This is one of the rare triangles that I very much like to see. SPX 60min chart:

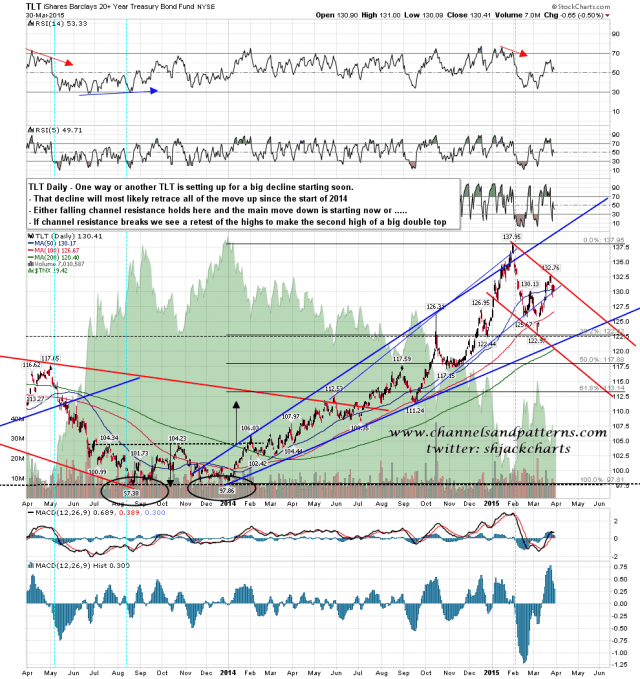

On bonds I’m doing a post looking at the bigger picture but the quick summary is that we should be starting a move here that should wipe out all of the gains from the start of 2014. That sounds pretty wild I know but not as wild as my call for a big rally at the start of 2014 when everyone else expected a big decline. Chances are this will happen too. If the falling channel on my chart below holds then the next leg down of that move is starting now. If channel resistance is broken then I’d expect a retest of the highs to make the second high on a double top. TLT daily chart:

I like my triangle scenario here and if that scenario is right then it’s going to be a seriously fun summer. Bulls are on must perform today though and they have to hold support this morning. If bears can fill yesterday’s opening gap at 2061.02 then my larger triangle scenario will be in trouble and we may be going a lot lower. A break below 2039 would open up 1960 as a target. If bulls can keep that gap unfilled and hold the daily middle band on the close today then I’ll be looking for a hit of triangle resistance in the 2112 area next, and new highs not too long after that. Let’s see how the battle at support goes this morning.