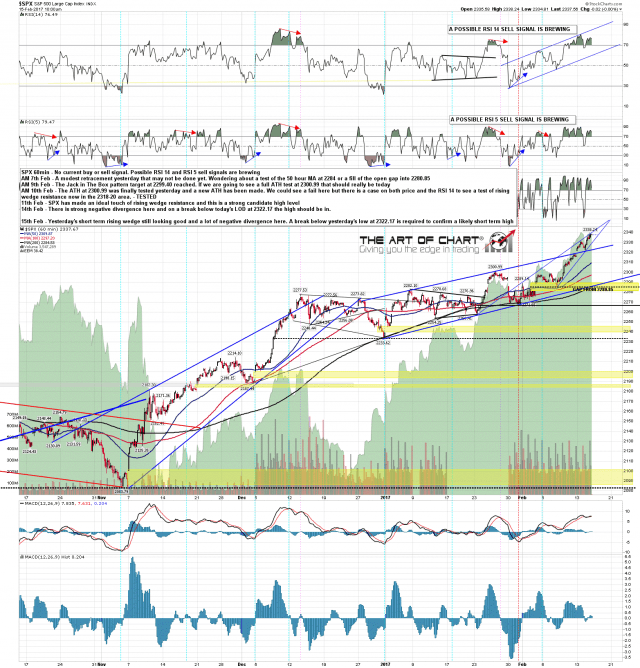

Another new all time high this morning and SPX is still on a daily upper band ride. That could end at any time but we’re going to need to see some evidence before having any confidence in a turn here. This move up from the last low is in a decent little rising wedge and obviously that rising wedge support needs to break, but the key level that needs to break is yesterday’s low at 2322.17. A break below would be a significant sign of weakness and the short term high (at least) would likely then be in. There is a lot of negative divergence on the hourly chart and the rising wedge on price and rising channel on the RSI 14 are firmly leaning bearish. SPX 60min chart:

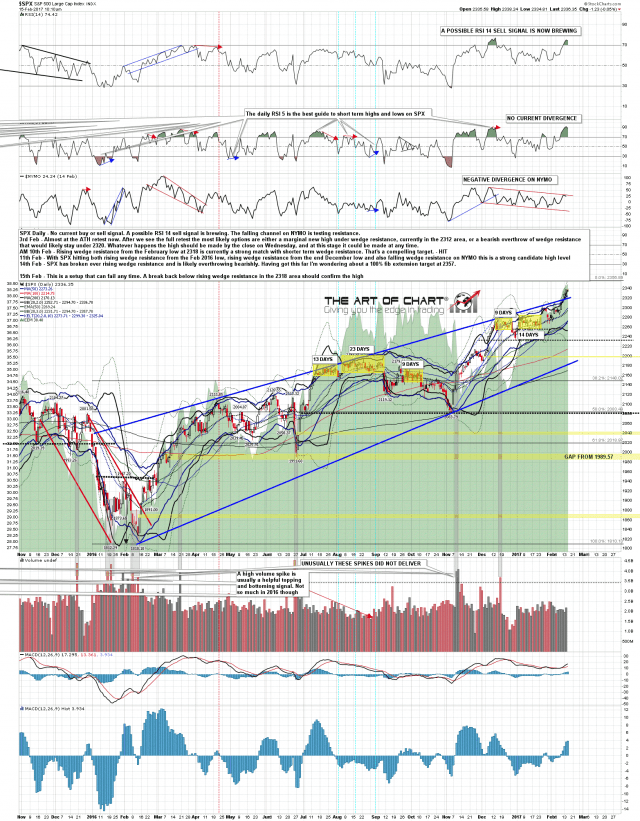

On the daily chart SPX is likely overthrowing wedge resistance and confirmation of a likely turn would come with a daily close back under wedge resistance, currently in the 2318 area. If SPX does manage to continue higher there is a 100% fib extension target in the 2357 area that I am watching. SPX daily chart:

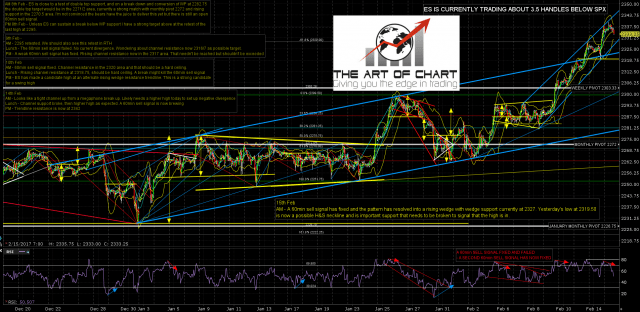

On ES the short term pattern is a very decent looking rising wedge with wedge support currently in the 2327.50 area. ES Mar 60min chart:

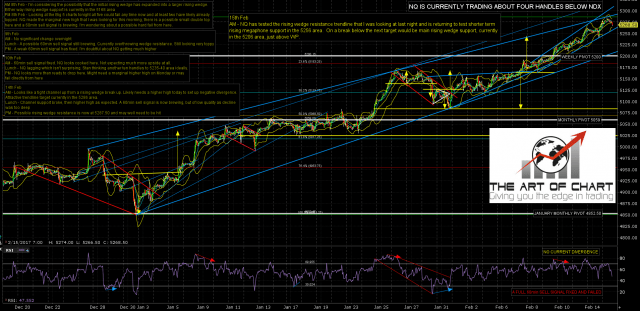

On NQ the overnight high was at the possible rising wedge resistance trendline that I was looking at yesterday morning in my premarket video (posted on twitter at the time). Short term rising megaphone support is now in the 5258 area, and a break below would open up a test of rising wedge support, currently in the 5207 area. NQ Mar 60min chart:

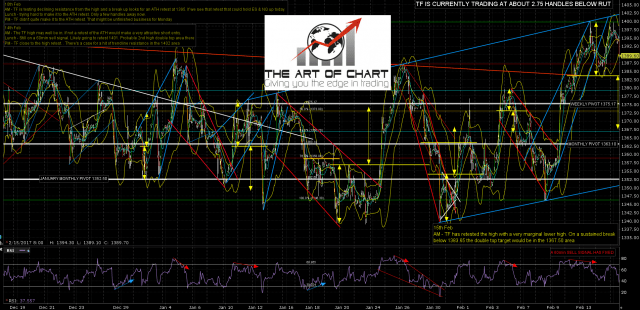

On TF the overall pattern is a very decent rising megaphone with resistance in the 1402 area. There is already a very decent looking double top setup here that on a sustained break below 1383.65 would look for the 1367.50 area. TF Mar 60min chart:

Overall this is a really nice looking topping setup and there’s nothing here so far to strongly suggest that that is a break up. Could it nonetheless be a break up? Yes, there are no sure things in the market and precious few in the universe at large. Nonetheless the odds favor a fail here.

I have heard the comment that hardly any other analysts are looking for a high here, but I don’t tend to pay much attention to that, and haven’t in the past noticed much correlation between the number of people expecting a market outcome and the odds of that happening. A really high level of unanimity is a warning sign in my view, and the biggest analyst and trader train wreck in recent years had almost everyone on the wrong side. I wrote a post looking at that in May 2014 and that’s worth a read if you are a believer in the power of the majority view. You can see that here, As far as I was aware there were only three analysts worldwide who called that correctly, I can’t recall who the other two were. The market will turn here or it won’t, there’s only one way to find out for sure and that is to wait and see. In the meantime the odds favor the downside here, but given the strength of this move I’m waiting to see some evidence of weakness to signal that the turn is in.