Wednesday is my busiest day of the week and I didn’t manage to get a post out yesterday. I am going away for the weekend and may not manage to get one out tomorrow either, so I’m making today’s post as comprehensive as possible. Before the RTH open today I tweeted the premarket video I recorded this morning for Daily Video Service subscribers at theartofchart.net & you can see that here. If you trade USD, oil, natural gas, gold or treasuries then updates for DX, CL, NG, GC & ZB are included in the video as well.

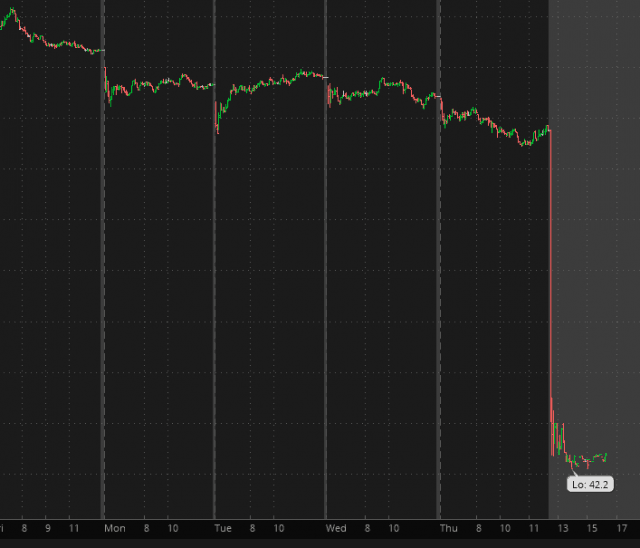

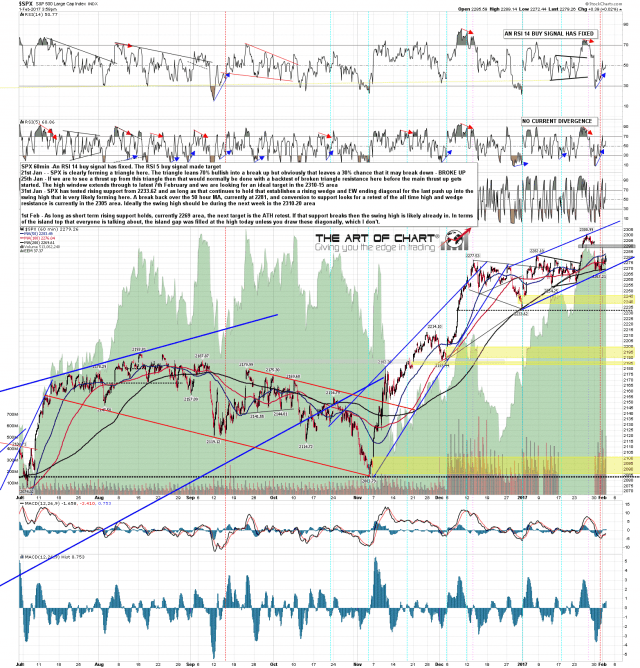

On the 60min chart SPX confirmed a small rising wedge from the 2233 low on Tuesday and as and when that rising wedge support breaks the swing high here will likely be in. That’s been retested this morning and is holding so far. As long as that remains the case the next obvious target on SPX is a retest of the all time high. Whatever happens we are looking for this swing high by the close on Wednesday 8th February. SPX 60min chart:

(more…)