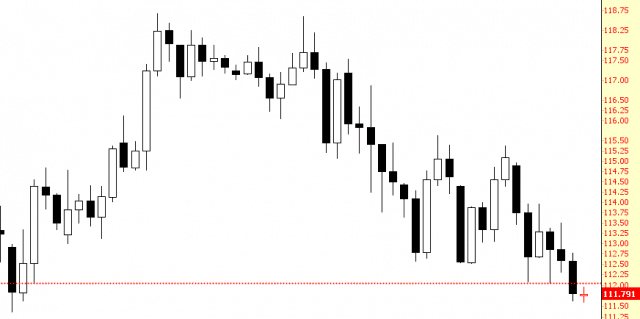

Just a quick post before I head to bed – – the USD/JPY is key to watch. Weakness here will continue to be of aid to equity bears. I’ve also got a short on DXJ, which obviously also needs the Yen to play along. This has nothing to do with any of that, but I’ll just say in passing energy is increasingly my favorite sector, with more of my shorts concentrated in that zone. Anyway, here’s the USD/JPY:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Building Blocks V: Volatility (by The Director)

Before we discuss the basic of options parameters for trading, we need to understand the concept of volatility. This is not simply an observational number, thought it can be used as such. In general stock investors want to avoid volatility. They want to minimize the standard deviation of their investments, as large drawdowns can be petrifying to some. This is a reaction that encompasses more than trader psychology; when the broker taps you on the shoulder with his margin call, it really is game over for you. This can be unfair, but those with the gold set the rules.

(more…)

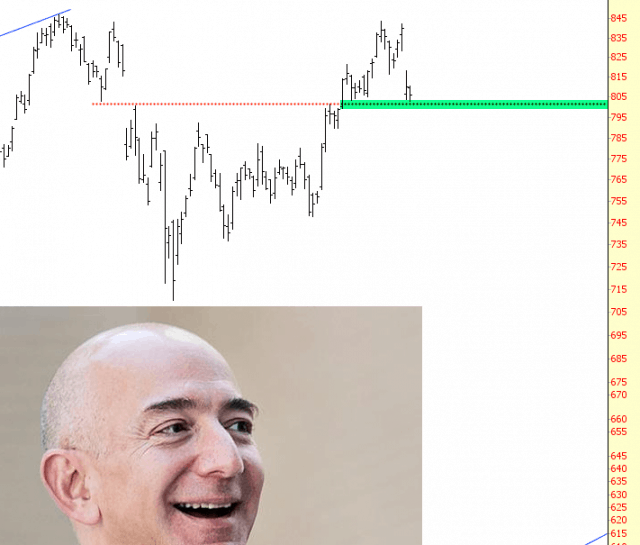

Important Support for Amazon

Watch $800 on AMZN. If it breaks, look out below. Not that its P/E ratio of 184 isn’t a deal.

Probability Spectra

This is an important week on equities with likely highs coming on SPX, NDX & maybe RUT too. This high will likely last several months. There are couple of questions that I am still getting regularly that I’d like to address at the start of this week.

How certain are we (Stan & I) that our scenario will deliver here? We are not certain at all, because there is precious little certainty in the universe and none at all in the markets. We have a high level of confidence, within the obvious constraint of the reality that we are forecasting with math rather than magic. Our working assumption is that certainty in market forecasting is less common than unicorns, and that analysts offering certainty are either charlatans or delusional. On planet Earth everything is on a spectrum of possibilities.