I didn’t get to the post in RTH today, so I thought I’d do something different today and have a close look at NDX (Nasdaq 100). This is worth doing as there can be little doubt which index has been driving the bull bus in recent months, so I’ve been looking it carefully and am taking the opportunity to share what I’m seeing there tonight, with my normal mainly SPX-centric view back for tomorrow’s post.

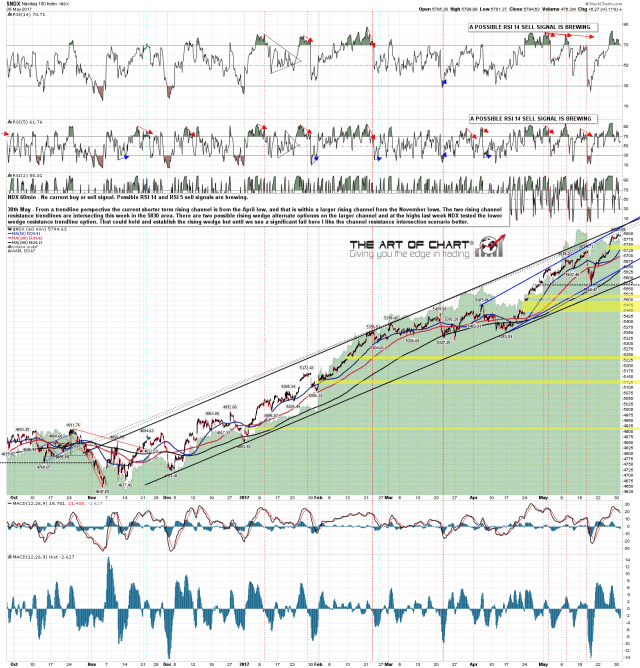

The shorter term setup here is a rising channel from the April low within a larger rising channel from the November ’16 lows. The two channel resistance trendlines are intersecting this week in the 5830 area and that is the obvious target for NDX this week.

That said there is a lot of negative divergence on NDX here, with both RSI 14 and RSI 5 sell signals brewing and close to fixing on the hourly chart, and I have drawn in two possible rising wedge resistance trendlines for the channel from the Nov ’16 lows. Both are high quality options and the lower option has already been tested. Whichever trendline is the correct one would be confirmed with a test here and then a subsequent test of trendline support from that low, currently in the 5575 area. NDX 60min chart:

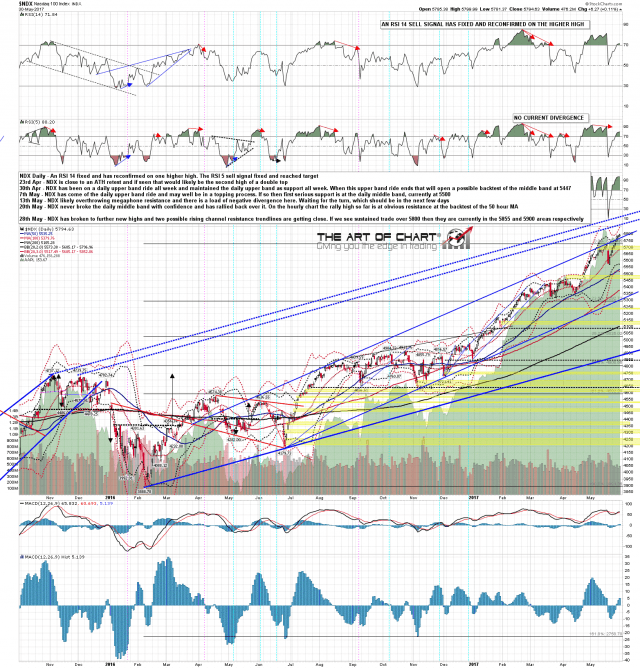

What if NDX tests those channel resistance trendlines and breaks over the resistance there? Well there is a higher option that I’m looking at here as a possibility. On the daily chart below I have two possible rising channel resistance trendline options from the February 2016 low, with those currently in the 5855 and 5900 areas respectively. NDX daily chart:

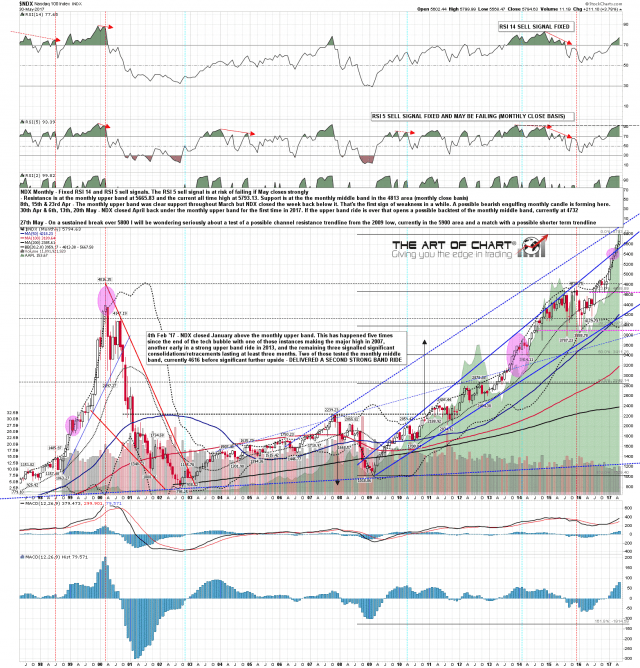

What’s interesting though is that on the monthly chart I have possible rising channel resistance from the March 2009 low also currently in the 5900 area. I’m not expecting to see 5830 resistance broken, and it may not even be tested, but if NDX breaks up, then the 5900 area makes a compelling alternate target. NDX monthly chart:

The ES and NQ futures charts below were done after the close for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

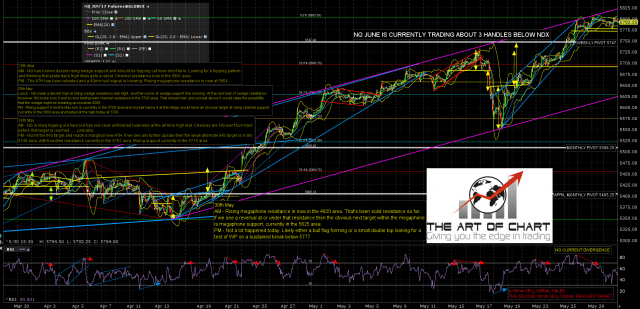

On NQ the rising megaphone resistance is a decent match with rising channel resistance on NDX, with the differences here being that on NQ the trendline has already been tested, and that the 60min sell signal that fixed on NQ over the long weekend made target at the open this morning, along with the open sell signals on both ES and TF. NQ Jun 60min chart:

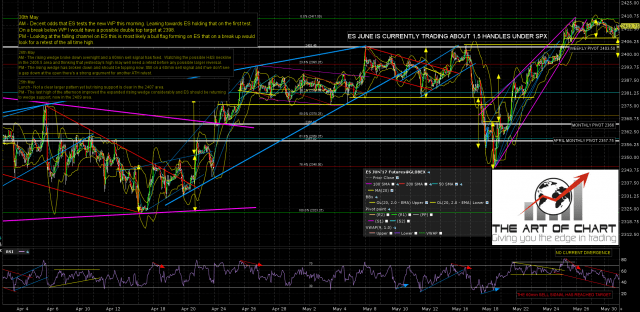

On ES the pattern from the ATH last week is a shallow falling channel which is most likely a bull flag. On a break up the minimum target would be a retest of the ATH, As that is a very short journey that doesn’t necessarily mean anything in terms of the other indices. ES Jun 60min chart:

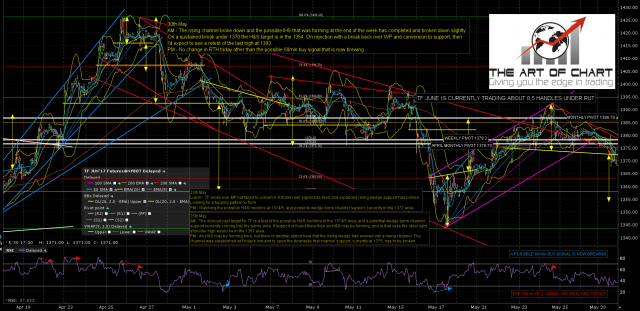

On TF, as ever the most bearish of these three indices, an H&S has formed and broken down slightly. If this break down is sustained then the target is in the 1354 area. A strong rejection would look for a retest of the last high at 1393. TF Jun 60min chart:

Whatever happens next this upswing looks almost tapped out short term, and the chances of a new ATH with any confidence in the near future on SPX/ES look low, tapering down to very low on RUT/TF. If there is anything even moderately impressive remaining on the upside it will likely be on NDX/NQ, and even that looks close to a high here.

Stan and I are doing our monthly free public Chart Chat webinar at theartofchart.net on Sunday afternoon at 4pm EDT, and if you’d like to attend then you can register for that on our June Free Webinars page. I would also note that this week’s edition of The Weekly Call is posted and that the model portfolio there is up 178% over the last six months, looking well on course to make our target minimum 200% return over the first year. As and when that target is reached we’re thinking of making the strategy there a bit less conservative. That’s a free weekly service and if you trade futures I’d suggest adding it to your reading list.